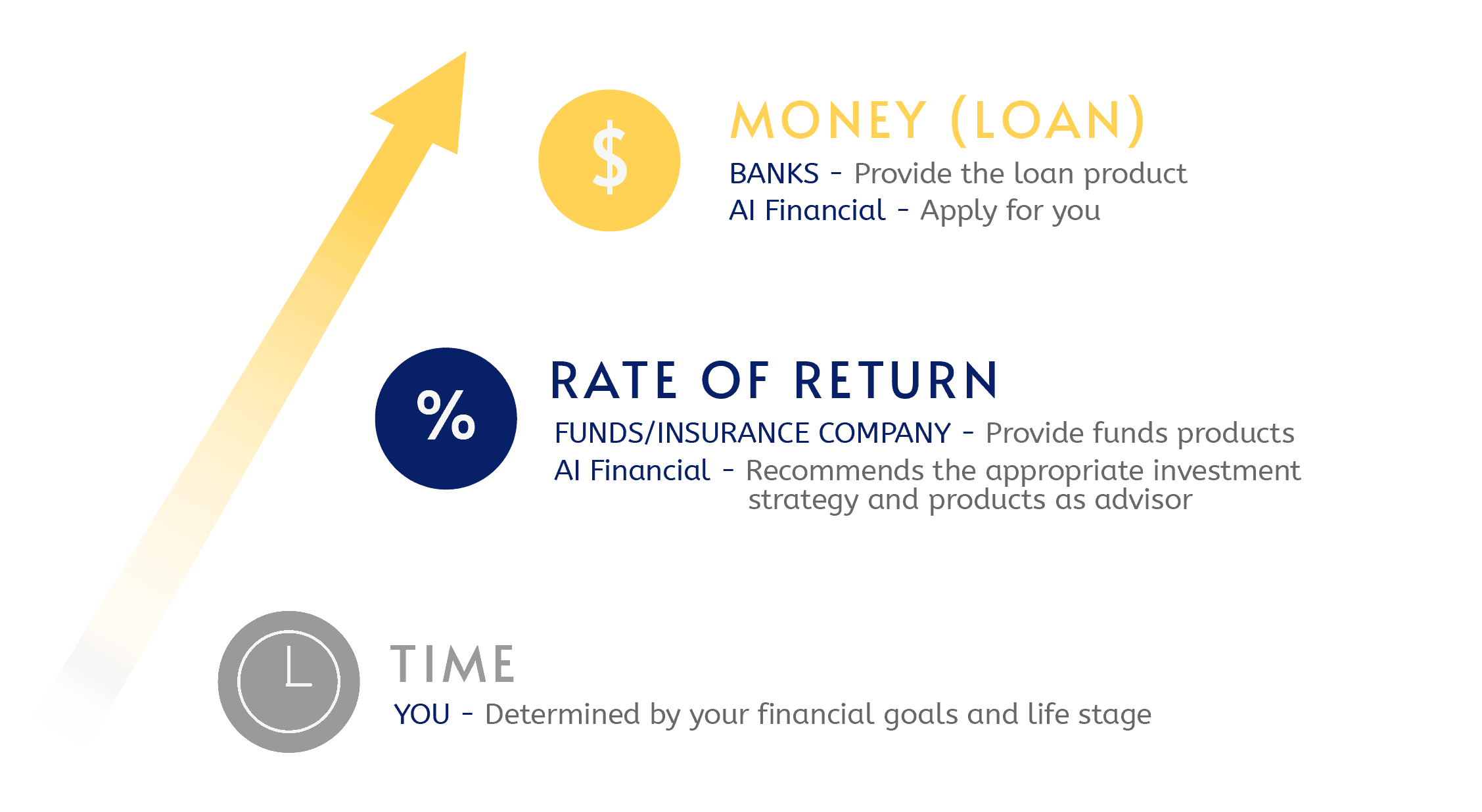

How does investment loan work?

Benefits of Investment Loan

-

No collateral

No physical assets are given as collateral, and only credit scores are measured. -

Low interest

P+0.75%, lower than that of housing mortgage under the same circumstances. -

Only the interest is required to be paid

Pay monthly interest only, with little pressure. -

No margin call

The bank has no margin call when the market fluctuates and falls.

With investment loan, you can……

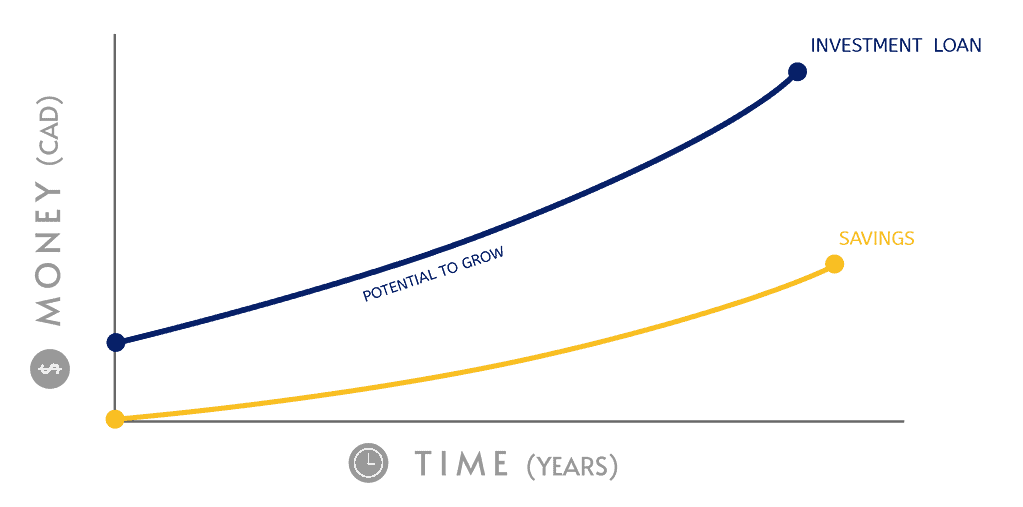

1. Fast forward your savings

With a traditional savings plan, only the investment you make in the first year will have the full 20 years to grow. Each subsequent year, the amount you contribute will have less time to grow.

If you invest $15,900 every year for 20 years at a return rate of 18.8%, after 10 years, your investment will reach $462,152; after 20 years, your investment will reach $3,050,062.

However, if you annually pay $15,900 as interest on a $200,000 loan, you will have the original principal of $200,000, which will grow at a rate different from that of your own funds.

After 20 years, your investment will reach $6,071,318 (deducting the $200,000 loan), providing an additional gain of $3,021,256 compared to a traditional savings strategy.

2. Investment lending

A financial strategy that can for the right investor, help achieve your financial planning goals sooner by making a larger initial investment.

A way for investors to potentially grow their investment portfolio faster than traditional saving alone.

Investment loans can be a suitable tool to help with longer-term savings goals or to supplement RSP and government pensions in retirement.

How much do you need to invest today to match your financial goal?

INVESTMENT LOAN STORIES

Read how other Canadians have used an investment loan to achieve their goals.

Any Questions?

You only need to pay interest each month, without any principal repayment. If you borrow $100,000, your monthly payment will be only $662.5.

Depending on individual/family circumstances, such as your investment goals, risk tolerance, etc., please consult our advisors for assistance in creating a suitable plan.

Yes, our office staff will guide you on how to view your investment accounts, which are held under the fund companies associated with the products you have purchased, unless we have your signed authorization. We cannot access your funds. Our services are transparent, secure, and reliable.

All loans are sourced from legitimate Canadian banks such as National Bank, B2B Bank, Manulife Bank, and others. Once borrowed, the funds enter the client's own account. We do not engage in private lending business.

You can withdraw and use the profit portion of your investment at any time without any time restrictions.

You can withdraw up to 10% of the profit portion annually without incurring any fees.

Invest NOW

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.