How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow jumps 300 points to a new record as small caps lead market rebound

Market Overview:

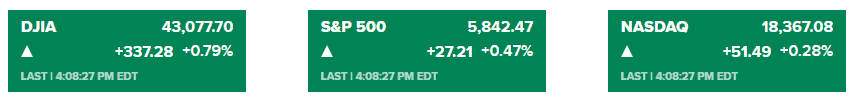

U.S. stocks rallied on Wednesday, rebounding towards record highs after a mixed performance in the previous session. The Dow Jones Industrial Average gained 345 points, or 0.8%, closing at a new high of 43,077.70. The S&P 500 rose 0.5%, and the Nasdaq Composite increased by 0.3%. Nvidia led a rebound in chip stocks with a 3.1% jump, following Tuesday’s dip after ASML cut its 2025 sales forecast. Morgan Stanley’s quarterly earnings report exceeded expectations, boosting its shares by nearly 7%, while United Airlines rose 15% on strong quarterly results and an optimistic outlook for the end of 2024.

Despite some market volatility earlier in the week, overall investor sentiment remained positive. Around 50 S&P 500 companies have reported third-quarter earnings so far, with 79% beating analyst expectations, according to FactSet. Treasury yields also slightly decreased, with the 10-year yield falling to 4.01%.

Corporate News:

- Boeing Co. is considering raising approximately $15 billion through shares and convertible bonds, according to sources.

- J.B. Hunt Transport Services Inc. reported third-quarter profits that exceeded estimates, while revenue declined less than expected.

- Qualcomm Inc. may delay its decision to bid for Intel Corp. until after the U.S. presidential election in November.

- U.S. Bancorp saw net interest income surpass estimates due to rising borrowing costs benefiting its fixed-rate assets.

- Novavax Inc. shares dropped after U.S. regulators paused trials for its influenza and COVID-19 combination vaccine due to a participant developing a serious nerve disorder.

- Abbott Laboratories slightly raised its full-year profit outlook, driven by continued strong demand for its diabetes devices.

- Airbus SE plans to cut up to 2,500 jobs in its defense and space division to improve efficiency.

- Warburg Pincus is considering a buyout of German IT services firm Nagarro SE, reflecting continued dealmaking momentum in the country.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More