Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreMarkets Wrap: Dow Falls Nearly 350 Points, Snapping Three-Day Win Streak as Earnings Season Approaches

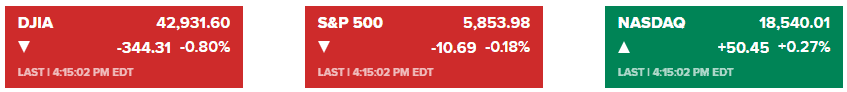

Market Overview:

The Dow Jones Industrial Average fell on Monday, reversing some of last week’s gains as Treasury yields rose, signaling concerns about prolonged high interest rates. The S&P 500 slipped 0.18% to 5,853.98, while the Dow lost 344.31 points (0.8%), closing at 42,931.60. The Nasdaq Composite managed a 0.27% increase, ending at 18,540.01.

Consumer and homebuilder stocks were notably weak, with Target down 3.8% and Builders FirstSource off 5.2%. The yield on the 10-year Treasury increased by nearly 12 basis points to 4.19%, leading to speculation that the Federal Reserve may be slower to cut interest rates due to a resilient economy.

Earnings reports will be closely watched this week, with approximately 20% of S&P 500 companies scheduled to announce results. So far, 75% of the 14% of companies that have reported exceeded expectations, though analysts have lowered their earnings forecasts significantly.

Despite recent declines, market sentiment remains cautiously optimistic, with investors aware of potential volatility stemming from stretched valuations and geopolitical risks.

Corporate News:

- Spirit Airlines Inc. soared after securing more time to address its debt load, alleviating bankruptcy concerns.

- Kenvue Inc. rallied following news that activist investor Starboard Value took a stake in the company, indicating potential changes to boost its stock price.

- Qualcomm Inc. unveiled a new processor aimed at bringing laptop-level capabilities to smartphones, enhancing the devices’ ability to leverage new AI tools.

- Microsoft Corp. launched a suite of AI tools designed to automate tasks such as email management and record keeping for business workers, intensifying competition with rivals like Salesforce Inc.

- Walt Disney Co. appointed James Gorman as chairman of the board and announced plans to appoint a new CEO in early 2026.

- Kering SA faced a setback as Citibank Inc. downgraded its stock to neutral, removing a buy rating held for over a decade, just ahead of a sales update.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More