How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Posts Back-to-Back Loss as S&P 500 Falters Amid Fed Uncertainty

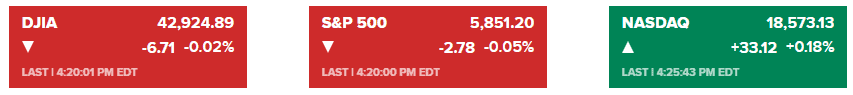

Market Overview:

On Tuesday, U.S. stock markets closed with mixed results as investors balanced concerns over rising interest rates and assessed corporate earnings reports. The S&P 500 ended slightly lower by 0.05% at 5,851.20, while the Dow Jones Industrial Average dropped 6.71 points (0.02%) to 42,924.89. In contrast, the Nasdaq Composite outperformed, gaining 0.18% to close at 18,573.13. The 10-year U.S. Treasury yield climbed above 4.2% for the first time in three months before retreating slightly, driven by cautious remarks from Federal Reserve officials regarding future rate cuts.

Homebuilding stocks, including Lennar and D.R. Horton, fell over 3% due to persistent concerns about higher interest rates. Traders are closely watching the upcoming Federal Reserve meeting, where there is an 89% chance of a quarter-point cut expected, according to CME’s FedWatch tool.

Despite the ongoing rally in the stock market, risks remain as traders grow wary of rising oil prices, potential fiscal deficits post-election, and a more cautious Federal Reserve stance on rate cuts. Treasury yields remained near 4.2%, and concerns about global economic growth continue to weigh on investors.

Corporate News:

- Verizon: Shares dropped 5% after the company reported lower-than-expected revenue, mainly due to weaker hardware sales such as mobile phones.

- General Motors: The company jumped nearly 10% after beating third-quarter earnings expectations and raising its full-year profit forecast.

- Philip Morris: The Marlboro maker surged roughly 10%, raising its annual profit forecast, driven by strong demand for its Zyn nicotine pouches in the U.S.

- Lockheed Martin: Shares fell 6% after reporting lower-than-expected third-quarter sales, impacted by weak aeronautical sales and issues with its F-35 program.

- 3M: Raised the low end of its 2024 profit forecast after better-than-expected earnings, citing improved productivity efforts.

- General Electric: Although GE reported better profit outlooks, its sales fell short of Wall Street expectations, partly due to supply chain challenges affecting its jet engine deliveries.

- Kimberly-Clark: The company lowered its full-year organic sales forecast after reporting weaker-than-expected results.

- Zions Bancorp: Reported better-than-expected net interest income, with Morgan Stanley anticipating a continued positive trajectory into 2025.

- L’Oreal: Posted disappointing sales as the beauty company faces declining consumer demand in China.

- Huawei: An investigation into Huawei’s latest AI offering revealed that its advanced processor was produced by Nvidia’s manufacturing partner, Taiwan Semiconductor Manufacturing Co., highlighting China’s ongoing struggles to produce its own advanced chips in large quantities.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More