Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreMarkets Wrap: S&P 500 Rises for First Gain This Week, Ending Losing Streak as Tesla Surges 22%

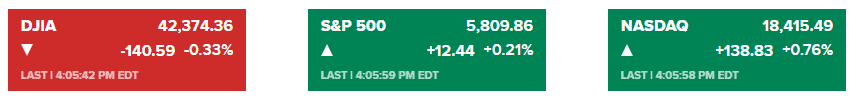

Market Overview:

U.S. stocks saw a modest rebound, breaking a three-day losing streak. The S&P 500 added 0.21%, while the Nasdaq Composite surged 0.76%. The Dow Jones Industrial Average, however, continued its decline, losing 140.59 points, or 0.33%, marking its fourth consecutive losing session.

Tesla led the S&P 500 with an impressive 22% gain after strong third-quarter results exceeded expectations, pushing the stock toward its best day since 2013. Treasury yields retreated, with the 10-year Treasury yield easing from three-month highs, topping 4.25% in the previous session. Despite ongoing concerns about high rates, the market remains cautiously optimistic as earnings season progresses.

Roughly 160 S&P 500 companies have reported earnings so far, but results have been mixed. The overall growth rate stands at 3.4% year-over-year, falling short of analysts’ expectations.

Corporate News:

- Tesla Inc. surged over 22% after reporting robust earnings and projecting as much as 30% growth in car sales next year, making it the best performer in the S&P 500.

- Boeing Co. suffered a 1.5% drop as factory workers rejected a new labor contract that would have raised wages by 35% over four years.

- United Parcel Service Inc. (UPS) climbed 5.2% after returning to sales and profit growth, signaling economic resilience.

- IBM fell over 6% after its consulting revenue missed analyst estimates.

- Molina Healthcare jumped 19% on better-than-expected earnings, alongside gains from Whirlpool and UPS.

- American Airlines Group Inc. raised its full-year profit guidance as it rebounds from a previous failed sales strategy, despite high costs.

- Southwest Airlines Co. posted third-quarter profits more than double Wall Street estimates, aided by ending a struggle with activist Elliott Investment Management.

- Yum! Brands Inc. removed fresh onions from some Taco Bell, Pizza Hut, and KFC locations due to an E. coli outbreak.

- ServiceNow Inc. reported strong sales as the company expanded its AI tool suite.

- Whirlpool Corp. posted better-than-expected earnings and reaffirmed its full-year forecast.

- Harley-Davidson Inc. cut its full-year forecast after a decline in motorcycle shipments due to waning demand.

- Peloton Interactive Inc. received a positive note from David Einhorn of Greenlight Capital despite its stock’s steep decline over three years.

- Lam Research Corp. reported better-than-expected quarterly results, offering relief after ASML’s weaker report.

- T-Mobile US Inc. raised its forecasts for new subscribers and earnings after beating expectations for mobile and broadband customer growth.

- Newmont Corp. slumped as its earnings suggested challenges in controlling mining costs despite high gold prices.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More