Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreMarkets Wrap: Tech Tumbles Lead S&P 500 and Nasdaq to Worst Day in Over a Month, Ending October on a Sour Note

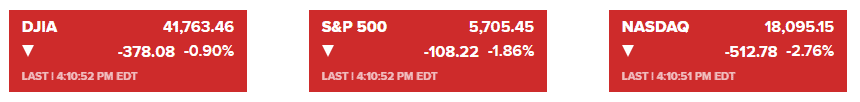

Market Overview:

Stocks fell sharply on Thursday as Wall Street reacted to disappointing quarterly results from major tech companies and awaited further earnings announcements. The S&P 500 declined 1.86% to 5,705.45, marking its largest one-day drop since early September. The Nasdaq Composite slipped 2.76% to 18,095.15, and the Dow Jones Industrial Average lost 378.08 points, or 0.9%, closing at 41,763.46. Both the S&P 500 and Nasdaq are on track for their biggest weekly declines since early September, impacted by concerns that tech sector growth may not meet elevated expectations.

Microsoft shares fell 6% after it issued cautious revenue guidance, overshadowing positive quarterly earnings. Similarly, Meta Platforms dropped more than 4% due to weaker-than-expected user growth and a projected increase in capital expenditures in 2025. Despite strong revenue growth, Alphabet’s earnings reports were also met with mixed reactions, as chipmaker AMD fell over 10% on disappointing guidance for the upcoming quarter.

Adding to market jitters, the latest personal consumption expenditures (PCE) price index showed inflation at 2.1% year-over-year for September, aligning with expectations and nearing the Federal Reserve’s 2% target. This PCE reading, alongside Friday’s payroll and unemployment data, will play a key role in informing the Fed’s upcoming interest rate decision on Nov. 7.

October concluded with modest losses across major indexes amid election-related uncertainty. The S&P 500 declined 1% for the month, and the Nasdaq lost 0.5%, while the Dow Jones slid 1.3%. Additionally, Treasury yields rose, as did oil prices due to ongoing Middle East tensions, while gold slightly retreated following its recent highs.

Corporate News:

- Microsoft Corp. – Microsoft shares slid 6% as cautious revenue projections dampened enthusiasm around its quarterly earnings beat. Investors are questioning whether recent investments in artificial intelligence will yield significant short-term returns.

- Meta Platforms Inc. – Meta saw a 4% drop after user growth fell short of expectations, and the company warned of a substantial increase in capital expenditures in 2025, highlighting ongoing challenges in user engagement.

- Apple Inc. and Amazon.com Inc. – Apple and Amazon are set to report earnings later today, which may provide crucial insights into consumer demand for iPhone AI features and the state of Amazon’s e-commerce and cloud computing divisions, respectively.

- Alphabet Inc. – Alphabet’s shares rose nearly 3% following strong revenue growth, showcasing some initial returns on its AI investments, though market skepticism around the broader tech sector remains.

- Mastercard Inc. – Mastercard reported higher-than-expected profits, driven by an increase in cross-border transactions, which supported its earnings during the quarter.

- ConocoPhillips – The energy giant raised its production forecast for the year after surpassing Q3 output expectations, reflecting strong performance amid favorable market conditions.

- Samsung Electronics Co. – Samsung announced advancements in supplying AI memory chips to Nvidia, aiming to alleviate investor concerns over competition with SK Hynix in the AI market.

- Bristol Myers Squibb Co. – The company raised its 2024 earnings guidance, driven by demand for Eliquis and new treatments, positioning it for continued growth in the pharmaceutical sector.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More