Analysis of the Toronto Condo Market Crash. With the GTA...

Read MoreMarkets Wrap: Dow Rallies 400 Points, S&P 500 Gains as Tech Drives Market Ahead of U.S. Election Results

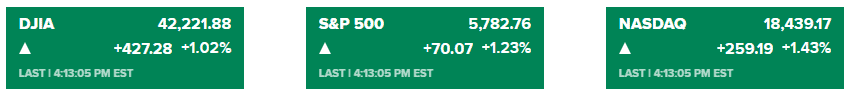

Market Overview:

U.S. stocks rallied on Tuesday as traders anticipated the results of a closely contested presidential election. The S&P 500 rose 1.23% to 5,782.76, the Nasdaq Composite gained 1.43% to 18,439.17, and the Dow Jones climbed 427.28 points, or 1.02%, to close at 42,221.88. This broad market rally reflected cautious optimism despite the potential for post-election volatility.

Key tech and financial stocks led the advance, with shares of Nvidia up nearly 3%, Tesla rising 3.5%, and the SPDR S&P Bank ETF (KBE) increasing 1.6%. Markets are also watching the Federal Reserve’s upcoming interest rate decision and Chair Jerome Powell’s statement on Thursday. A quarter-point rate cut is expected, following a recent half-point reduction.

With a tight race between former President Donald Trump and Vice President Kamala Harris, both the presidential outcome and the party majority in Congress remain critical for potential shifts in fiscal and tax policies. Investors are bracing for potential short-term market fluctuations, as historically, stocks experience choppiness immediately following Election Day. Additionally, Treasury yields and the U.S. dollar saw slight fluctuations, while data showed the U.S. service sector expanding at its fastest pace in over two years.

Analysts at Goldman Sachs suggest resilience in the U.S. economy could support equities despite election-related volatility, projecting only an 18% chance of a bear market in the coming year. In a week primed for market movement, options data indicates a possible 1.8% swing in either direction for the S&P 500 on Wednesday.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More