Analysis of the Toronto Condo Market Crash. With the GTA...

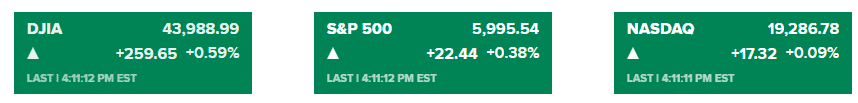

Read MoreMarkets Wrap: Dow Reaches 44,000, S&P 500 Hits 6,000 in Election Week Rally

Market Overview:

The stock market reached new heights this Friday, capping off its strongest week in a year following Donald Trump’s recent election victory. The Dow Jones Industrial Average rose 260 points (0.6%), crossing the 44,000 mark for the first time, while the S&P 500 climbed 0.4%, surpassing the 6,000 level. Despite a relatively flat day, the Nasdaq Composite achieved an intraday record, marking a robust week across all three major indexes. The S&P 500 and Dow gained approximately 4.7% each, their best performance since November 2023. The Nasdaq outperformed with a 5.7% advance, and the Russell 2000 led with a weekly gain of over 8%.

The rally was driven by investor optimism about Trump’s anticipated pro-growth policies, which could lead to deregulation and potential tax cuts. Small-cap stocks, which are expected to benefit from Trump’s protectionist approach, attracted significant inflows. The S&P 500’s milestone at 6,000 has added to positive market sentiment, drawing in sidelined funds from money markets and bonds. This surge was also supported by the Federal Reserve’s recent decision to cut interest rates by a quarter-point, reinforcing confidence in sustained economic growth as the year closes.

Corporate News:

- Tesla Inc. began leasing its Cybertruck, with rates starting at $999 per month, adding momentum to its recent gains.

- Paramount Global, the parent of CBS, MTV, and Paramount Pictures, reported third-quarter revenue below analysts’ expectations, despite strong growth in streaming subscribers.

- Expedia Group Inc. exceeded gross bookings forecasts for the third quarter and raised its full-year guidance, signaling strong demand going into the holiday season.

- Airbnb Inc. issued an optimistic forecast for the holiday period due to strong demand trends, alleviating investor concerns about growth deceleration.

- Pinterest Inc. projected weaker sales for the holiday quarter, highlighting its struggle to compete with larger social media platforms like Meta and Snap.

- Block Inc. reported third-quarter revenue below analyst expectations, impacting its growth outlook.

- DraftKings Inc. reduced its 2024 revenue and profit forecasts due to a challenging start to the fourth quarter.

- Rivian Automotive Inc. expects positive gross profit in Q4, bolstered by an increase in regulatory credit sales despite earlier production disruptions.

- Sweetgreen Inc. faced a significant stock drop after reporting higher-than-expected labor and protein costs, leading to a wider-than-expected third-quarter loss.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites

A Vaughan man lost his deposit and faces legal action...

Read MoreExperts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites

Economists and rating agencies warn of structural slowing in Canada's...

Read MoreGold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites

Analyze the epic gold and silver market crash triggered by...

Read More