How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Nasdaq Rebounds as Tesla Rally Ends Five-Day Slide

Market Overview:

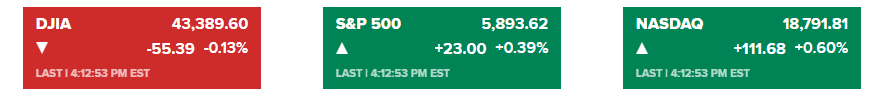

The Nasdaq Composite gained 0.6% on Monday, closing at 18,791.81, as Wall Street recovered from a challenging week. The S&P 500 rose 0.4% to 5,893.62, while the Dow Jones Industrial Average slipped 0.1% to 43,389.60. Treasury yields declined, with 10-year yields falling three basis points to 4.41%. The Bloomberg Dollar Spot Index slid 0.4%.

Tesla led the Nasdaq’s rally, climbing 5.6% amid reports that President-elect Donald Trump’s team is working on a federal framework to ease self-driving vehicle regulations. Apple, Netflix, and Advanced Micro Devices also posted gains, rising 1.3%, 2.8%, and 3%, respectively.

Nvidia shares fell 1.3% following reports of overheating issues with its Blackwell AI chips, ahead of its earnings report later this week. Investors remain focused on earnings reports, with 93% of S&P 500 companies having reported so far. Notably, 74% have exceeded earnings expectations and 62% have surpassed revenue estimates.

Corporate News:

- Nvidia Corp.: Shares fell as reports emerged about overheating problems with its new Blackwell GPUs, prompting design changes for server racks.

- Super Micro Computer Inc.: Shares surged 16% as the company approached a deadline to file its delayed 10-K report or submit a plan to avoid Nasdaq delisting.

- MicroStrategy Inc.: Acquired 51,780 Bitcoin for $4.6 billion, marking its largest crypto purchase since initiating acquisitions four years ago.

- Spirit Airlines Inc.: Filed for bankruptcy due to intensified competition and financial challenges following its failed merger with JetBlue.

- CVS Health Corp.: Appointed Larry Robbins, founder of Glenview Capital Management, to its board as part of an agreement with an activist firm.

- Liberty Energy Inc.: CEO Chris Wright was nominated by President-elect Donald Trump to head the Energy Department.

- Newmont Corp.: Agreed to sell its Musselwhite gold mine to Orla Mining Ltd. for up to $850 million, part of its strategy to improve shareholder returns.

- Hewlett Packard Enterprise Co.: Upgraded to “strong buy” by Raymond James, citing strong performance potential.

- Moderna Inc.: Upgraded to “buy” by HSBC, with analysts highlighting the undervalued potential of its drug pipeline.

- Biogen Inc.: Downgraded to “hold” by Needham, which expressed concerns over a lack of near-term upside for the stock.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More