How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Rallies 450 Points as Trump Trade Lifts Stocks, Bitcoin Nears $100K

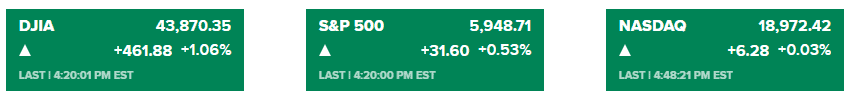

Market Overview:

U.S. stocks ended higher on Thursday as investors shifted focus to cyclical stocks tied to the economy, rotating away from technology shares.

- Dow Jones Industrial Average: Gained 461.88 points (+1.06%), closing at 43,870.35.

- S&P 500 Index: Added 0.53% to finish at 5,948.71.

- Nasdaq Composite: Edged up 0.03%, ending at 18,972.42.

- Russell 2000 Index: Advanced over 1%, supported by optimism about economic growth under President-elect Donald Trump.

Bitcoin reached a new intraday high, surpassing $99,000, amid hopes for a regulatory boost under Trump’s anticipated policies. Treasury yields steadied at 4.42%, while the dollar strengthened after mixed labor data, which included lower-than-expected jobless claims but a rise in continuing claims to a three-year high.

Energy prices also climbed, with WTI crude futures nearing $70 per barrel, driven by geopolitical tensions following escalations in the Russia-Ukraine conflict.

Corporate News:

- Nvidia Corp.: Shares fluctuated after posting better-than-expected Q3 results and issuing strong guidance. Despite earlier concerns over slowing revenue growth, Nvidia ended the day 0.5% higher, continuing its upward momentum with a 190% YTD gain.

- Snowflake Inc.: Surged nearly 33% after exceeding Wall Street estimates and raising product revenue guidance for the fiscal year.

- Alphabet Inc.: Dropped nearly 5%, continuing its slide over antitrust concerns.

- Amazon.com Inc.: Fell 2.2%, reflecting broader tech sector weakness.

- Salesforce Inc.: Gained 3.1%, standing out in the tech-heavy Nasdaq index.

- MicroStrategy Inc.: Plunged following a negative report from Citron Research, citing concerns over its Bitcoin-heavy strategy.

Cryptocurrency Update

Bitcoin’s rally continued, surpassing $99,000 as investors bet on supportive crypto policies under a Trump administration. The potential departure of SEC Chair Gary Gensler and the possibility of Chris Giancarlo becoming the first “crypto czar” are fueling bullish sentiment.

Geopolitical Factors

Escalations in the Russia-Ukraine war boosted oil and gold prices. Russia reportedly launched an intercontinental missile, while Ukraine’s use of UK-provided missiles marked another escalation. Analysts suggest adding oil or derivatives to portfolios as a hedge against geopolitical volatility.

Global Developments

Shares of India’s Adani Group dropped sharply after U.S. prosecutors charged its founder with bribery allegations, prompting the cancellation of a $600 million bond sale. The company denied the charges, which could further impact investor sentiment in Asia.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More