How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Drops 200 Points as Nvidia Slides, Stocks Pause Ahead of Inflation Data

Market Overview:

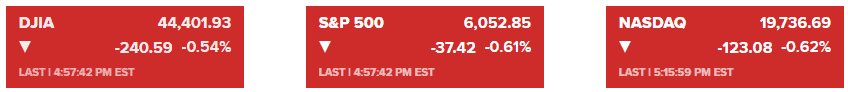

US stocks retreated on Monday, pausing after a record-setting rally. The S&P 500 fell 0.61% to close at 6,052.85, the Nasdaq Composite slid 0.62% to 19,736.69, and the Dow Jones Industrial Average dropped 240.59 points, or 0.54%, to settle at 44,401.93. These declines followed fresh record highs reached last week, with the S&P 500 and Nasdaq up 1% and 3.3% respectively over the prior week.

Investors are closely watching inflation data set for release on Wednesday, with economists predicting a 0.3% monthly increase in the consumer price index (CPI) and an annual rise of 2.7%. These figures will offer critical insight into the Federal Reserve’s next steps regarding interest rates.

The yield on the 10-year Treasury rose to 4.20%, while the Bloomberg Dollar Spot Index gained 0.1%. Oil prices climbed as China signaled plans for stronger economic stimulus, further supporting energy markets.

Bitcoin retreated after reaching a milestone last week, topping $100,000 for the first time. The cryptocurrency’s dip reflects a broader pullback in risk-taking across markets.

Corporate News:

- Technology Sector:

- Nvidia Corp.: Shares fell 2.6% after China launched an antitrust investigation regarding its 2020 deal, potentially challenging Nvidia’s dominant AI position. Despite this setback, Nvidia remains a key AI trade leader, having gained over 180% in 2024.

- Advanced Micro Devices (AMD): AMD shares plummeted 5.6% following a downgrade by Bank of America, citing competitive risks in AI against Nvidia’s dominance.

- Consumer and Retail:

- Macy’s Inc.: Barington Capital Group urged the company to implement drastic measures to boost its stock price.

- Mondelez International Inc.: The snack giant is reportedly exploring a merger with Hershey Co., potentially creating a $50 billion food powerhouse.

- Cryptocurrency:

- MicroStrategy Inc.: The company purchased an additional $2.1 billion in Bitcoin, drawing scrutiny over its financing strategies, which include a mix of equity and fixed-income securities sales.

- Telecom and Media:

- T-Mobile US Inc.: CEO Mike Sievert cautioned investors about a “back-end loaded” fourth quarter, impacting expectations.

- Warner Bros. Discovery Inc.: Renewed an agreement with Comcast to continue providing networks like CNN and TNT to Comcast’s 12.8 million cable-TV subscribers.

- Mergers and Inclusions:

- Apollo Global Management Inc. and Workday Inc.: Both companies will join the S&P 500 index, replacing Qorvo Inc. and Amentum Holdings Inc. This change is effective before the market opens on December 23.

- Steel Industry:

- Nippon Steel Corp.: Outlined plans for US mill investments as part of efforts to secure approval for its bid to acquire United States Steel Corp.

The market remains focused on inflation data and its potential impact on Federal Reserve policy, while corporate developments add further volatility to sectors like technology, media, and retail.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More