Leverage Small Investments

for Rapid Growth

Investment loans allow you to use a small amount of money to access larger capital, helping accelerate investment growth and achieve greater financial returns.

Trusted Partner Lending Banks

What is an Investment Loan?

An investment loan allows you to borrow funds and invest in higher-value assets like segregated funds, which can accelerate your wealth-building journey.

By borrowing capital, you are able to invest more than you could with savings alone, maximizing your potential returns.

Maximized Initial Capital

Boost Portfolio Growth

Effective Wealth Building

Secure Investment Options

Our Service

A Step-by-Step Guide to Leveraged Investing

Secure Loan

The first step in leveraged investing is to apply for a loan through Ai Financial's online self-directed investment platform, accessing funds from trusted Tier 1 Canadian banks and financial institutions.

Invest Strategically

Borrowed funds are invested in secure, growth-oriented assets like segregated funds. With Ai Financial's management, these investments aim to surpass borrowing costs.

Grow & Profit

You pay only the monthly loan interest, while Ai Financial handles market monitoring and portfolio adjustments. With segregated funds investments and a proven 20%+ average annual return, our strategy ensures returns far exceed interest costs—no client has ever incurred losses.

Loan Amount & Terms

Every individual could borrow up to $200k without assets or income proof.

The current interest rate is 6.2%.

Growth Potential

Segregated funds provide principal protection and growth potential, making it a safe and balanced choice for leveraged investing.

Fund Security & Protection

All actions need your signed approval—we never directly access your funds.

Your funds are fully protected by the insurance company and regulators.

Why You Need Investment Loan

Accelerate Your Investments

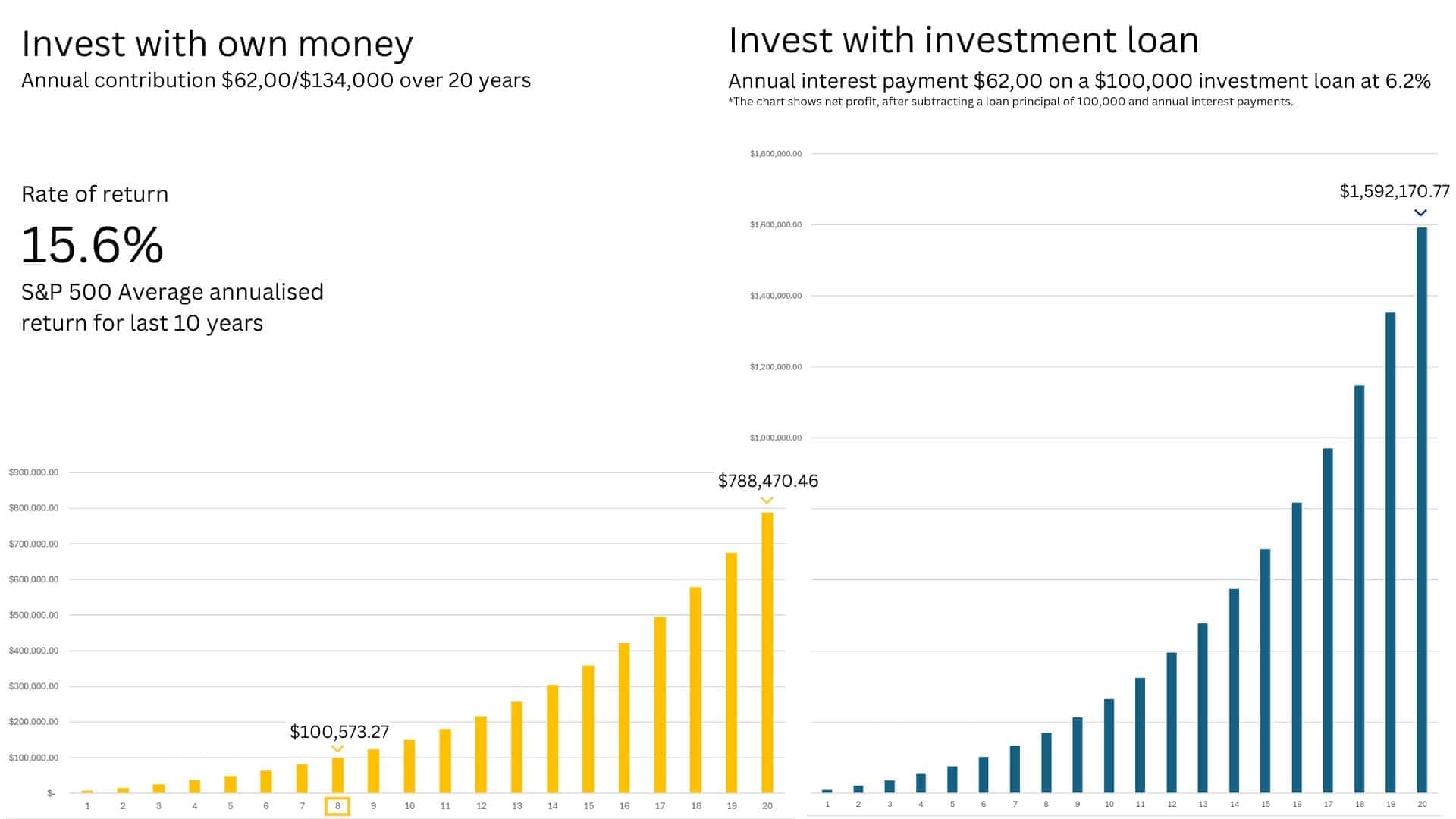

With a traditional savings plan, each year’s contribution has less time to grow due to diminishing years.

For example, $6,200 annually for 20 years at a 15.6% return grows to $788,470. However, with a $100,000 interest-only loan, the entire amount benefits for 20 years, growing to $1,592,171—$803,700 more than traditional savings.

This illustrates how investment loans can significantly accelerate savings growth.

Client Success Spotlight

Here are two real client success stories.

All screenshots are from actual client accounts.

See how investment loans and our expertise can help grow your wealth.

$140,000 Profit in 2.5 Years:

400% Real Return

Alex took a $200,000 investment loan with us in 2022 to invest in our recommended segregated funds. This year, his account profit has reached $140,000.

5 Years, double wealth:

$100,000 Becomes $250,000

Sophia’s investment return has already reached nearly 30% this year! In 2018, she took a $100,000 loan to invest. By last year, her assets had already doubled, with a profit of $150,000!

Your Money is in Good Hand

Why Ai Financial Leads

Ai Financial acts as your trusted broker, providing expert investment advice and handling loan and fund applications.

- Trusted institutions from Canada’s top banks and insurers

- Fully regulated for maximum security

- Funds stay safe in your personal account

- Access through licensed intermediaries only

- Consistently delivering over 20% annual returns

Trusted Canadian lender

Segregated Funds providers

We are regulated by

Ai Financial - ready to help you move forward

Ready to elevate your financial journey? Our team of financial experts is here to guide you every step of the way.

Common FAQs

Why Should I choose an Investment Loan?

An investment loan allows you to invest a larger sum upfront, benefiting from compounding returns and leveraging market growth sooner. By borrowing to invest, you can increase your returns without using your full capital, as long-term market returns often outpace the cost of borrowing. The interest on the loan may also be tax-deductible in some jurisdictions, providing an immediate tax benefit. Using the loan for low-risk segregated funds helps diversify your investments, while giving you more time to let your investments grow and maximize returns.

How does Investment loan differ from a regular personal loan?

An investment loan is specifically designed to fund investments, such as purchasing securities or segregated funds, while a regular loan can be used for a variety of personal or business expenses. Investment loans are often secured by the investment itself, whereas regular loans may or may not require collateral. Investment loans may offer flexible repayment terms, such as interest-only payments, to align with the growth of the investment, while regular loans generally have fixed repayment schedules. Additionally, interest on an investment loan may be tax-deductible in some cases, providing a potential tax advantage, which is not typically available for regular loans.

What types of investment can the loan be used for?

In Ai Financial our investment loan can only be used to invest in segregated funds. Segregated funds are low-risk investments that combine features of mutual funds and insurance, offering guarantees such as capital protection or maturity benefits.

What are segregated funds?

Segregated funds are investment products that combine the features of mutual funds with the added benefits of insurance. They pool investors’ capital, which is professionally managed to generate returns, while offering protections such as a guarantee of a portion of the original investment in case of market downturns. These funds provide a secure investment option, balancing growth potential with a degree of risk protection.

Are there any additional fees or hidden costs?

No, there are no hidden costs. At AI Financial, we pride ourselves on transparency. Here’s a breakdown of the fees involved:

- One-Time Service Fee: A single fee when you secure your investment loan with us.

- Loan Interest: Paid directly to the bank or financial institution providing the loan.

That’s it—no ongoing management fees or profit-sharing. Your success is entirely yours!

How will my investment be managed?

At AI Financial, your investment is managed with care and expertise:

Professional Oversight: Our team of experienced financial advisors ensures your loan is invested exclusively in segregated funds for optimal growth and security.

Risk Management: Segregated funds provide a guaranteed principal protection (75%–100%), offering a safety net against market downturns.

Active Monitoring: We monitor market trends and adjust strategies to keep your investment on track.

Hands-Off for You: We handle all the complexities, so you can focus on your financial goals while we work to grow your wealth.

How do I monitor the performance of my investments?

Track Your Growth in Real-Time

Our user-friendly app allows you to monitor your investments anytime, anywhere. Stay updated on your portfolio’s performance and see how your wealth is growing—all at your fingertips.