Discover how a Canadian family achieved 239% returns using strategic...

Read MoreAiF Client Tax Filing Notice

Dear Valued Clients,

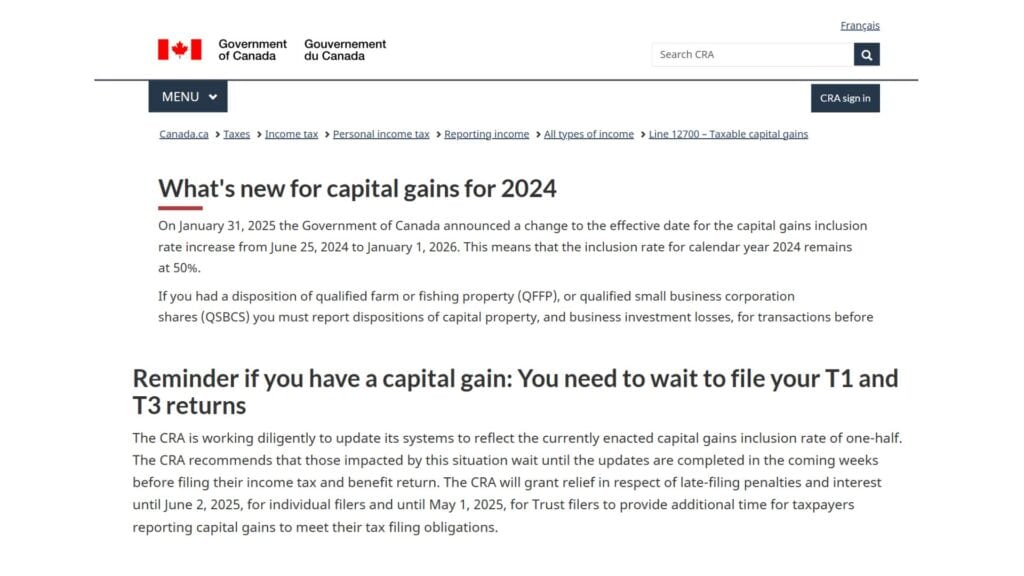

According to the latest notice from the Canada Revenue Agency (CRA), if you had investment income last year and require a T3 slip for tax filing, please consider delaying your tax return.

Previously, CRA had been implementing the federal Liberal government’s 2024 budget policy, increasing the capital gains inclusion rate to 66.7%. However, on January 31, CRA announced that due to Ottawa’s decision to postpone the capital gains tax reform effective date to January 1, 2026, the inclusion rate will revert to the original 50%.

CRA spokesperson Sylvie Branch stated that all relevant tax forms have been restored to the applicable 50% inclusion rate. However, updates to the tax system and certification of tax filing software are still in progress.

Branch also noted that until the tax software platforms are updated and certified, some users may be unable to print or submit their tax forms. Additionally, Notices of Assessment cannot be processed until CRA’s system updates are completed. The certification process for software handling capital asset transactions has already begun, with most platforms expected to be certified by the end of March.

The standard personal T1 filing deadline remains April 30. However, taxpayers awaiting tax slips may need additional time to file.

On January 31, CRA announced that individual taxpayers with capital gains transactions in 2024 can submit their returns by June 2, 2025, without incurring interest or late penalties. Financial institutions have also been granted additional time to issue tax slips.

Investment fund companies, which had initially prepared T3 slips based on the higher capital gains inclusion rate, are now reviewing and revising them, which may cause delays in issuing these slips to investors.

The filing deadline for T5008 (securities transactions) and some T5 (investment income) slips has been extended from February 28 to March 17.

Due to these delays, some tax slips may not immediately appear in CRA’s My Account, Represent a Client, or Auto-fill My Return services, affecting taxpayers who wish to file early.

The 2025 Winter Promotion is in full swing! Successfully apply to get approved for a $200,000 investment loan to receive an IPhone 16 Pro Max! More offers are available for a limited time—learn more now!

You may also interested in

Canadian Soldier Achieves 204% ROI with Investment Loan and Segregated Fund| AiF Clients

Zack, a Canadian soldier in his 40s, turned limited savings...

Read MoreFrom $100K to $520K: How a Millennial Actuary Couple Achieved a 154% Leveraged Return| AiF Clients

Discover how a millennial actuary couple used investment loans and...

Read MoreCan Non-Residents Invest in Segregated Funds in Canada?Hazel’s Journey with Ai Financial| AiF Clients

Hazel, a non-resident mother in Canada, invested CAD $200,000 across...

Read MoreFrom Anxiety to Empowerment: How a Mom of 3 Gained $67K in 20 Months | AiF Clients

Zara, a working mom of three, turned $200K into $259K...

Read More