Discover how a Canadian family achieved 239% returns using strategic...

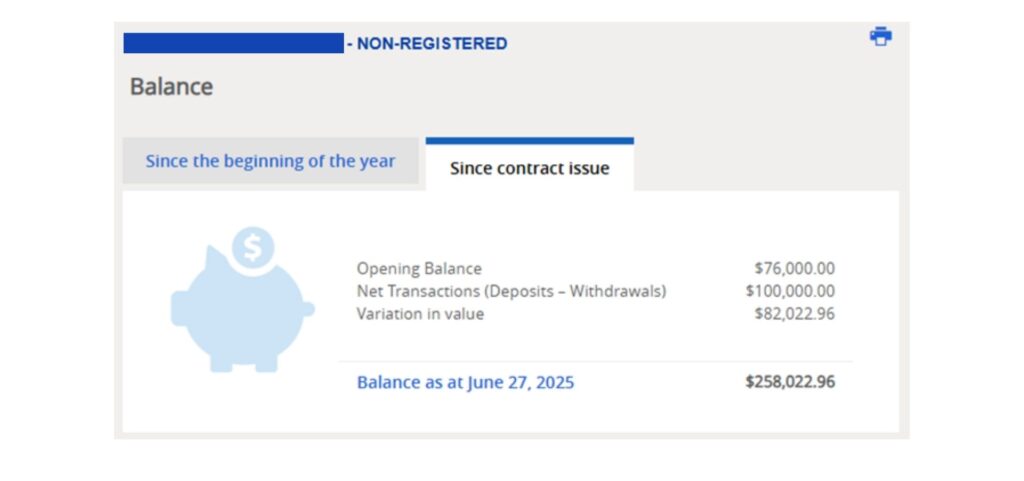

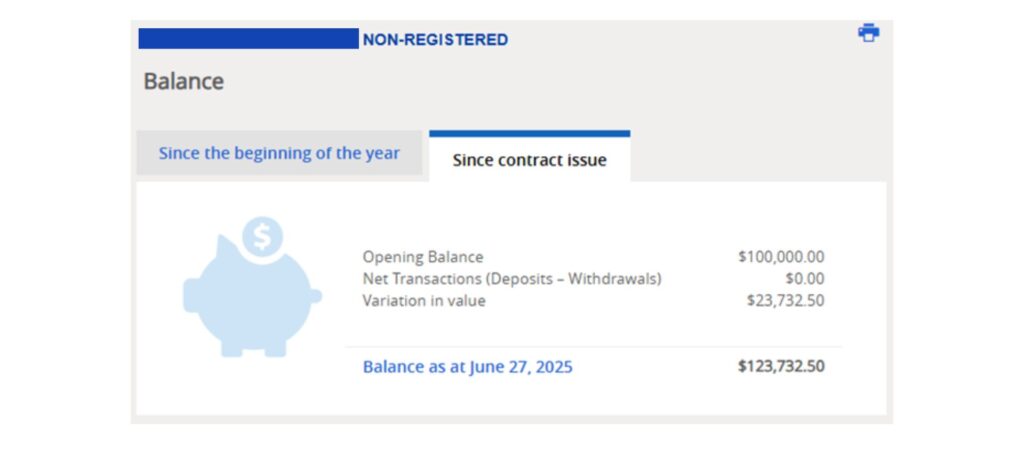

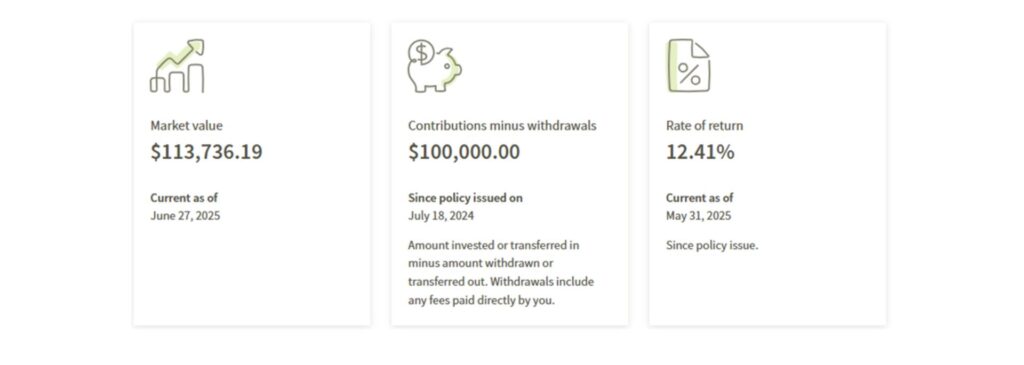

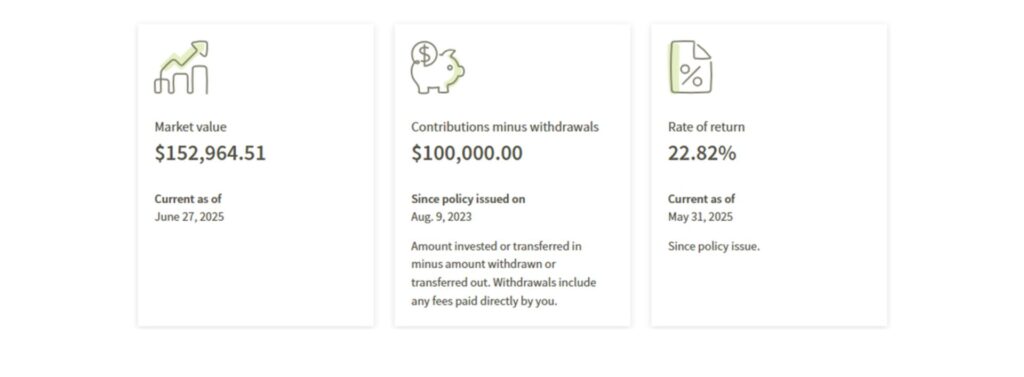

Read MoreAt the same time, under AiF’s financial planning guidance, Wendy opened a Non-Registered account in 2022 with an initial investment of $76,000. As the portfolio showed steady performance, her trust in AiF deepened. She added $60,000 more in November of the same year, followed by another $40,000 in August 2023.

From testing the waters to doubling down, every step was backed by visible expertise and a trusted strategy.

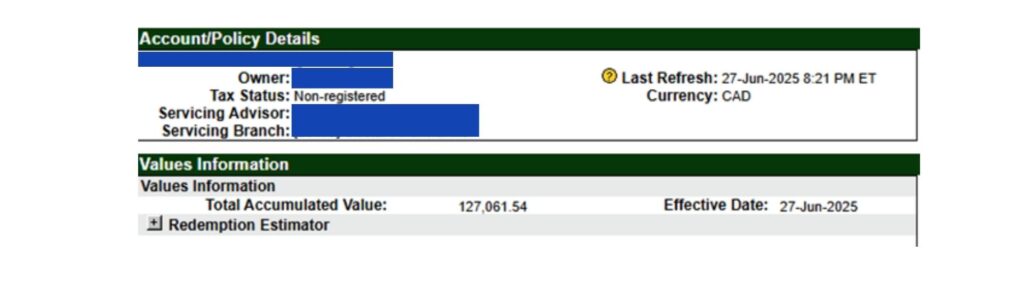

- Total Capital Invested: $176,000

- Total Portfolio Value: $258,022

- Total Profit: $82,022