In-depth analysis of five decades of Dow Jones Industrial Average...

Read MoreInsight

Black Monday: U.S. Stock Market Crash

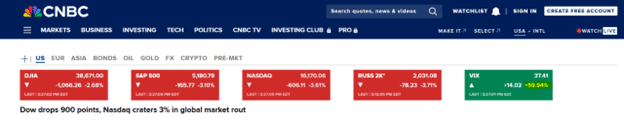

On Monday, August 5, 2024, the U.S. stock market plummeted. The Dow dropped over 1,000 points, the S&P fell over 200 points, and the Nasdaq declined over 800 points, with a drop of more than 4%. The VIX surged to 59.94% due to panic over the July unemployment rate, which rose from 3.6% to 4.3%, up from 4% in June, sparking fears of an imminent economic crisis.

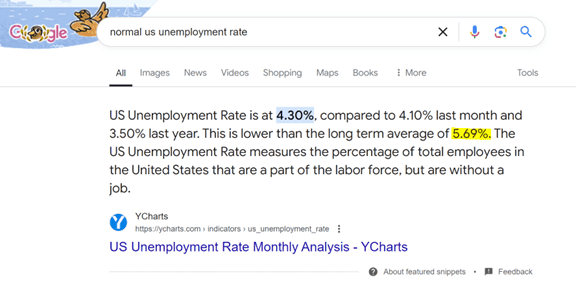

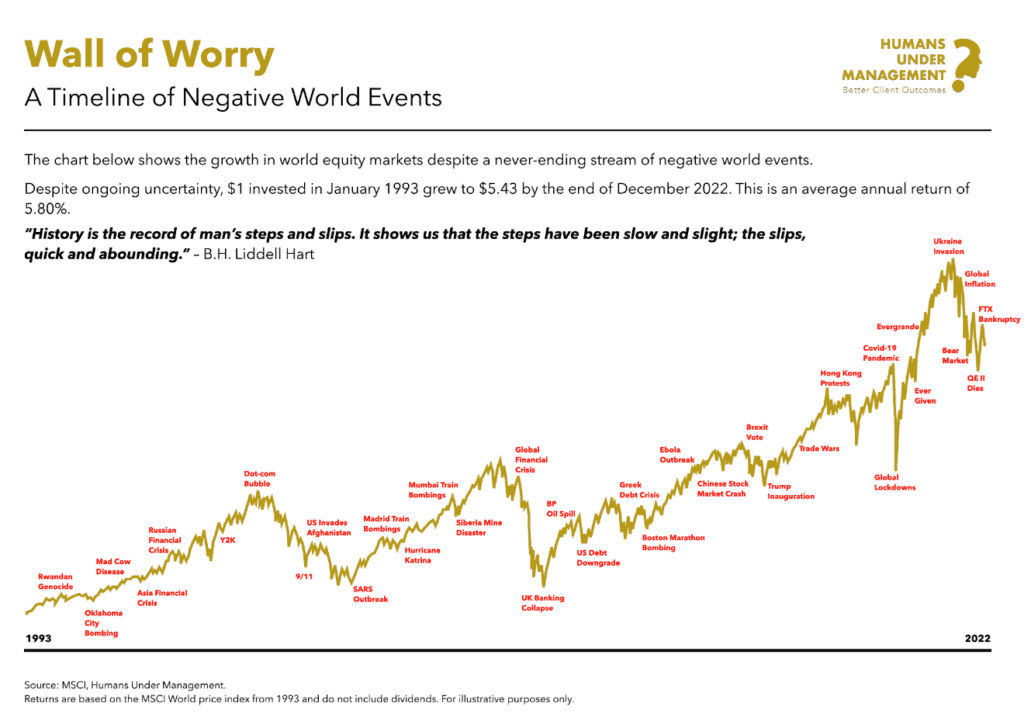

Despite the rise in unemployment to 4.3%, it remains well below the average of 5.69%. Recent rate hikes aim to stabilize an overheated economy, aligning with the Federal Reserve’s goals. Current data suggests the market is improving, cooling but not in crisis. Unemployment would need to exceed 5.69% to signal a recession. Market corrections are part of the Fed’s strategy to prepare for future growth.

Why is this positive data seen as negative?

It’s due to market adjustments, which aim to clear out speculative investors. Long-term investing focuses on staying resilient through market fluctuations to achieve success.

The question now is: Do you want to be a quitter or a winner?

You may also interested in

How to Make $100 Billion in a Day: What We Can Learn from Oracle’s Larry Ellison | AiF insight

New PWL Capital data shows renters in most Canadian cities...

Read MoreRenters Now Beating Homeowners in Canada: How Investing Outpaces Property Ownership | AiF insight

New PWL Capital data shows renters in most Canadian cities...

Read MoreWhy the Rich Focus and the Poor Get Distracted: The Hidden Law of Wealth | AiF insight

Wealth doesn’t come from chasing every trend. Ai Financial explains...

Read More2025 Canada National Risk Assessment on Money Laundering and Terrorist Financing| AiF Insights

The Government of Canada recently released the 2025 National Risk...

Read More