This post outlines various RRSP investment options for Canadians in...

Read MoreInsight

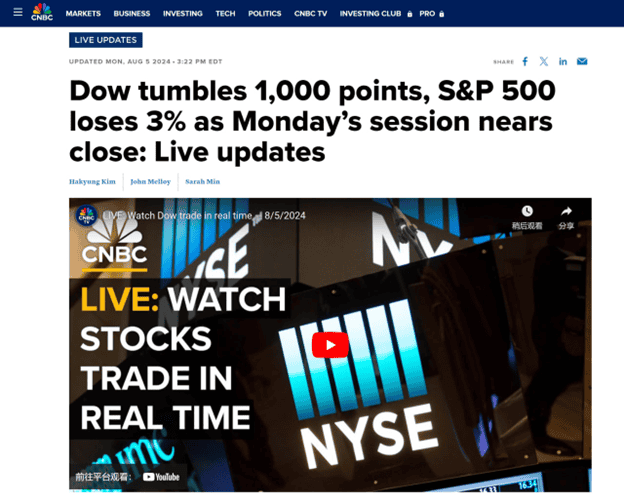

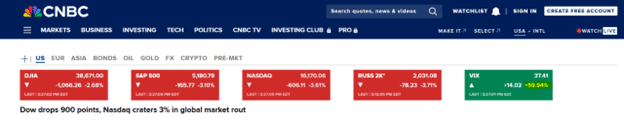

Black Monday: U.S. Stock Market Crash

On Monday, August 5, 2024, the U.S. stock market plummeted. The Dow dropped over 1,000 points, the S&P fell over 200 points, and the Nasdaq declined over 800 points, with a drop of more than 4%. The VIX surged to 59.94% due to panic over the July unemployment rate, which rose from 3.6% to 4.3%, up from 4% in June, sparking fears of an imminent economic crisis.

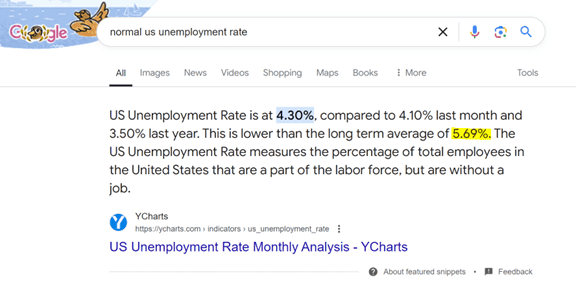

Despite the rise in unemployment to 4.3%, it remains well below the average of 5.69%. Recent rate hikes aim to stabilize an overheated economy, aligning with the Federal Reserve’s goals. Current data suggests the market is improving, cooling but not in crisis. Unemployment would need to exceed 5.69% to signal a recession. Market corrections are part of the Fed’s strategy to prepare for future growth.

Why is this positive data seen as negative?

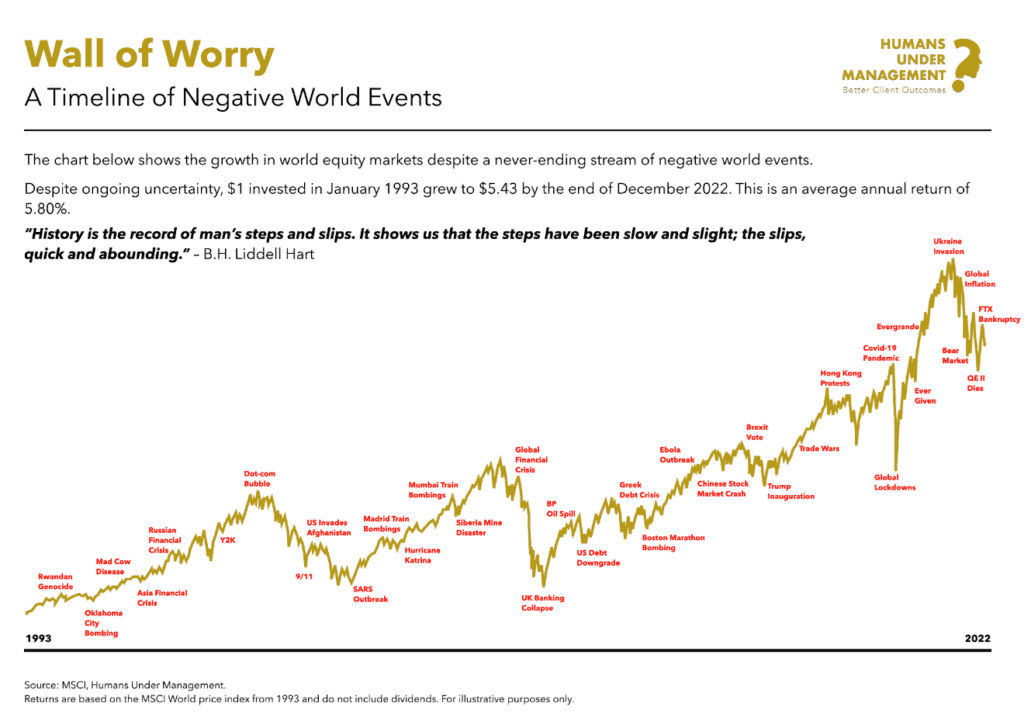

It’s due to market adjustments, which aim to clear out speculative investors. Long-term investing focuses on staying resilient through market fluctuations to achieve success.

The question now is: Do you want to be a quitter or a winner?

You may also interested in

Defense Stocks Are a ‘Mega Force.’ NATO, New Tech Make the Case| AiF insight

Driven by rising geopolitical tensions and the race for AI...

Read MoreBond King Bill Gross Predicts a “Little Bull Market” for Stocks and a “Little Bear Market” for Bonds| AiF insight

Renowned bond investor Bill Gross recently issued a new warning:...

Read MoreCanada, Brace for a “Decade of Austerity”| AiF insight

Inflation Eroding Savings, Debt Pressures Mount, Retirement Becomes a Luxury...

Read MoreFed Holds Rates – But a Rally May Be Coming| AiF insight

No cuts yet, but markets stay strong. Rate cuts could...

Read More