What is an investment loan?

Can this loan last a lifetime? Interest-only payments? Tax-deductible? Is it a private loan? Is the threshold high?

An Investment Loan is a unique Canadian offering specifically designed for investment purposes. According to the definition provided on the B2B Bank website, an Investment Loan refers to when a customer borrows money to purchase investment products with long-term potential for value appreciation.

So, how does this Investment Loan work? This article will introduce it through a real-life case study.

Real-life Case Study

Eric graduated in 2004 and now earns an annual income of $78,000 CAD. He and his wife, a homemaker, have one child. As their child grew, Eric realized that his current income might not be enough to cover future expenses. In 2020, he decided to utilize Ai Financial’s services.

After detailed analysis and assessment, we devised an Investment Loan plan for him, not only to help him generate tax-refundable income but also to yield investment profits. He successfully secured $100,000 loans from both B2B Bank and Manulife Bank.

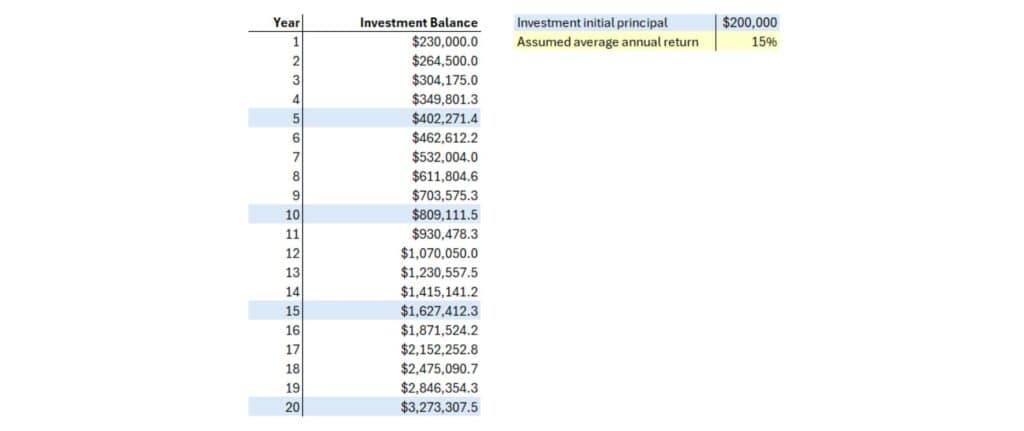

Next, let’s examine the potential profits from investing this money. Of course, the actual returns depend on the investment company’s capabilities. Using the Rule of 72, which suggests doubling every five years at an annual compounded return rate of 14.4%, we can assume an average rate of 15%. What would Eric’s account look like under these conditions?

The table shows that after five years, Eric’s account balance has doubled to $400,000. After ten years, it doubles again, and after twenty years, it would be 16 times the original principal. This means that after 20 years, Eric’s investment account would have over $3.2 million. After subtracting his $200,000 principal, he would have $3 million in cash flow.

These funds would be more than enough for Eric to retire early. He took out this investment loan when he was about 38 years old, so in 20 years, at 58, he could choose to retire just shy of 60. Alternatively, Eric could decide to keep working. If he continues following the doubling every five years rule, by the time he retires at 65, his investment account would have over $6 million.

Seeing the plan for this investment loan, Eric confidently applied. Although he could have qualified for a larger loan, which would have increased his principal and potential profits, Eric cautiously decided to start with a $200,000 loan. Now, let’s look at the actual growth of this money.

What did he really get?

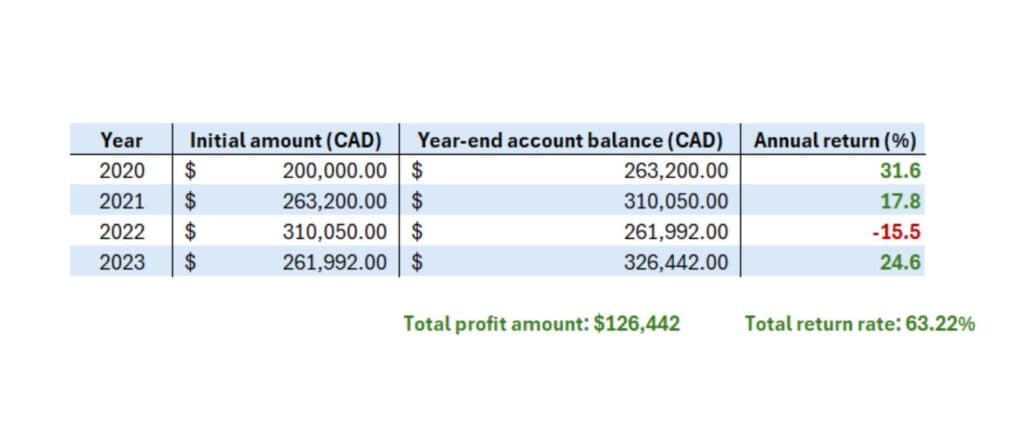

Despite not having invested for a full year in 2020, Eric still achieved a 31.6% return. In 2021, Ai Financial helped him secure a 17.8% return. In 2022, the stock market experienced a significant downturn, and Eric’s investments were not spared, with his account suffering a 15.5% loss. However, by June 2023, his account had already seen a 16% gain.

Overall, over three years, Eric’s investment loan account has generated a total profit of $126,442, with an overall return rate of 63.22%. This translates to an average annual return that exceeds the 15% rate we initially projected. For Eric, the real cost was the interest on the loan, but the returns on his investment loan far outpaced what he could have achieved using his own funds.

Additionally, the interest Eric paid on this investment loan was tax-deductible, significantly reducing his actual loan interest costs.

From Eric’s real-life example, it is clear that over the past three years, he has genuinely benefited from using an investment loan.

Eligibility Criteria

To qualify for an investment loan, there are three basic requirements:

- A credit score of 720 or higher.

- Permanent residency/Citizen of Canada for at least two years.

- At least two years of taxable income in Canada.

In addition to these basic criteria, lenders will also assess your assets, liabilities, income, and expenses to ensure you can afford the monthly interest payments. Before officially submitting your application to the bank, Ai Financial offers a free assessment to quickly determine if you qualify for a loan and how much you can borrow.

Apart from the three main requirements, there are six additional criteria that lenders like iA Trust consider:

1. Annual Income

Your annual income needs to meet specific thresholds, which vary depending on the loan amount. Qualifying income includes employment income, rental income, company dividends, and retirement income. Note that spousal support, spouse’s income, family tax benefit, employment insurance, social assistance, and disability insurance benefits are not considered.

2. Net Asset Value

Lenders prefer borrowers with high net assets, including the equity in your primary residence, investment properties, and other investments such as RRSPs, TFSAs, non-registered accounts, and bank savings.

3. Financial Habits

Good financial habits are crucial. This includes timely bill payments and not just making minimum payments on credit cards. A credit score of at least 680 is preferred. Stability in employment within the same industry also reflects good financial habits.

4. Investment Knowledge

Your understanding of investments, assessed through a pre-investment client questionnaire, indicates your knowledge level.

5. Risk Tolerance

Since investment loans involve leveraging, you need to have a higher risk tolerance and awareness. A thorough understanding of your investment strategy increases your approval chances.

6. Repayment Ability

It’s essential to demonstrate sufficient monthly repayment capability. This is measured by your Total Debt Service Ratio (TDSR), the ratio of all monthly debt payments to your monthly income. A TDSR below 35% is ideal.

Some institutions offer quick loans with fewer requirements, sometimes not even needing proof of assets, allowing you to borrow up to $100,000.

To find out how much you can borrow, please contact our financial advisors.

Product Features

Debt is a common part of life for many. Some borrow for education, others for homes or emergencies.

In our modern world, debt is normal. Good debt, like investment loans, can be a valuable tool. It helps generate income, boosts earning potential, and builds net worth.

Investment loans are good debt. They require investment in specified financial products and don’t allow for other uses. This protects both banks and investors.

These loans don’t need collateral or a down payment. They only require interest payments, not principal repayment. They also offer lower interest rates than mortgages and can provide significant returns.

Investment loans are often called “lifelong borrowing.” They offer permanent access to funds, with no immediate need to repay the principal. They’re like borrowing a hen that keeps laying eggs.

Moreover, the money obtained from investment loans is not affected by inflation. As time goes by, the purchasing power of money decreases, meaning it becomes less valuable. However, if you are the one who receives the loan, the burden of the loan diminishes over time, which is equivalent to earning money.

Lastly, leverage is the most significant feature of investment loans. It allows investors to amplify their investment capital by borrowing from banks, enabling them to start investing from a higher position and accumulate wealth.

In conclude, investment loan has 7 main features:

1. Designated funds for designated use

2. No collateral and down payment

3. Interest-only payments, no repayment of principal

4. Possibly tax-deductible

5. Perpetual renewal

6. Not affected by inflation

7. Leveraged investment

Is our investment loan right for you?

Yes, if you:

- Plan to invest for at least 10 years

- Have enough income to make your loan payments

- Have a high risk tolerance and be psychologically prepared for potential market fluctuations.

Investment loans are a leveraging tool and may not be suitable for everyone. Qualification is determined by the banks, and AiF can often assist clients who were previously denied elsewhere.

Talk to your advisor

Is investment loan right for you? How much can you borrow? Are the products we’ve chosen suitable for your situation? Consult our financial advisors to start your investment journey and let the powerful tool of investment loan help you achieve financial freedom faster.

Recent Posts

- Toronto Condo Market Crash: Inventory Surges in the $300k Range as Prices Reset | AiF News Bites February 10, 2026

- Nightmare in Vaughan: Pre-con Buyer Loses Life Savings | AIF Insight on Real Estate | AiF News Bites February 10, 2026

- Experts Warn: Canada’s Economic Growth Slows as Recession Risks Rise | AiF News Bites February 5, 2026

- Gold and Silver Market Crash: Historical Precious Metals Price Volatility Amid Shifting US Dollar Strength Expectations | AiF News Bites February 2, 2026

- Kevin Warsh Tapped as Next Federal Reserve Chair: A Potential Turning Point in the Jerome Powell Era | AiF News Bites January 30, 2026

- Amazon Global Job Cuts: 16,000 Positions Eliminated via Generative AI Job Replacement | AiF News Bites January 28, 2026

- U.S. Consumer Spending Remains the True Engine: Why AI Investment Impact on GDP is Overstated | AiF News Bites January 26, 2026

- Toys R Us Canada Bankruptcy: A Stark Warning on Retail Investment Risk| AiF News Bites January 22, 2026

- Canada Inflation Rebounce to 2.4%: Key Insights from December CPI Data | AiF News Bites January 19, 2026

- Ontario Home Sells at $600,000+ Loss as Buyers Gain Upper Hand in 2025 Housing Market | AiF News Bites January 16, 2026

Resources

Funds or Stocks? Which should I buy?

If you’re new to investing, it’s crucial to understand the differences between mutual/segregated funds and stocks to determine the best……

Invest in RRSP-Invest wisely, retire early

According to a recent survey by BMO, due to inflation and rising prices, Canadians now believe they need 1.7 million dollars in savings to retire……

TFSA withdrawal rules and limits

TFSA is ideal for both short-term needs and long-term investment growth. Withdrawals from TFSA are……