Explore our comprehensive guide to Canadian investment tools and accounts. Learn about RRSPs, TFSAs, investment loan, segregated funds, and more to enhance your financial strategy and maximize your investments.

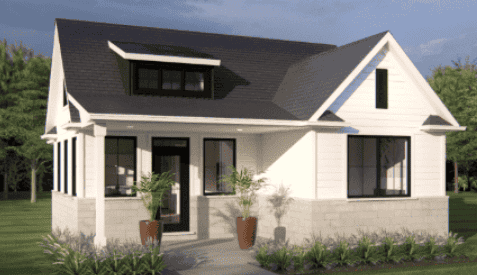

The First Home Savings Account (FHSA) is designed to assist first-time home buyers in Canada by allowing tax-deductible contributions and tax-free growth and withdrawals. However, eligibility requirements must be met, including age, residency, and first-time buyer status. Understanding these rules is crucial to avoid penalties and maximize savings.

Looking to boost your down payment with smart investing? The First Home Savings Account (FHSA) offers first-time buyers tax-free growth and flexible options to reach their homeownership goals faster. In this post, we share five smart FHSA investment tips to help you grow your savings, avoid penalties, and make the most of every dollar.

Thinking about your child’s future? Starting an RESP early can give them a major head start. From maximizing government grants to taking full advantage of compound growth, early contributions mean less stress later and more flexibility when it counts. In this article, we share the top 5 reasons why starting your child’s education savings plan now is one of the smartest moves a parent can make.

Explore the top 5 investment loan options for small business owners in 2025. Find the best fit to fund growth, buy equipment, or manage cash flow.

Segregated funds vs. mutual funds for estate planning

Want to grow your money tax-free? A Tax-Free Savings Account (TFSA) is one of the smartest tools for Canadian professionals. In this guide, you'll learn how to use a TFSA for everything from emergency savings to long-term investing—plus, see how one woman earned nearly $100,000 in just over a year by using hers wisely.

Learn about Canadian segregated funds, what they are, how they work, who can benefit, and whether or not they're a smart choice for you.

Segregated funds vs. mutual funds for estate planning

Wondering whether to invest through a TFSA or a non-registered account in 2025? This guide explains the key differences, tax rules, and how to choose the right one.

You can open a TFSA at any financial institution — but how do you invest in a TFSA to actually grow your money, instead of wasting your contribution room?