Mar 20 | Daily Finance News

Post Views: 731

U.S. STOCK PICKS

- The S&P 500 was little changed Wednesday as investors awaited the latest Federal Reserve policy decision.

- Wall Street eagerly awaits the Federal Reserve’s latest rate decision, with the central bank broadly anticipated to keep interest rates unchanged at the conclusion of its two-day policy meeting. Officials also will release their quarterly update on the economy, specifically for gross domestic product, inflation and the unemployment rate.

- Intel rose more than 1% on news that the White House plans to award the semiconductor company $8.5 billion in CHIPS Act grants.

- Chipotle Mexican Grill popped nearly 7% after announcing a stock split.

- Reddit investor Tom Sosnoff says IPO could benefit from being the only ‘pure social media’ stock.

- Weekly mortgage demand drops as interest rates rise again, but Fed announcement will be key for spring market.

CANADA MARKET

- Canada real estate: Cottage market expected to bounce back in 2024, says Royal LePage.

- After Statistics Canada released its consumer price index (CPI) report on Tuesday, showing annual inflation dropped 2.8 per cent with figures appearing softer than expected. Senior economist Kiefer Van Mulligen said that the persistence of elevated price growth for services is “the elephant in the inflationary room.”

Mar 20 | Daily Finance News

U.S. STOCK PICKS

Closing: 4:00 PM EST

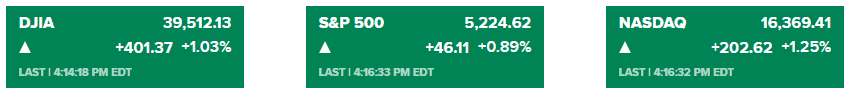

Stocks rallied on Wednesday, and all the major averages notched all-time closing highs.

- DJIA rose by 401.37 points, or 1.03%, to close at 39,512.13 points.

- The S&P 500 rose by 46.11 points, or 0.89%, to close at 5,224.62 points.

- NASDAQ rose by 202.62 points, or 1.25%, to close at 16,369.41 points.

The Federal Reserve held rates at a 23-year high and maintained expectations for three cuts before the end of 2024. That said, the central bank indicated that it needs greater evidence that inflation is easing before it starts taking its foot off the brakes.

- Financial stocks were higher after the Fed decision on the hope that rate cuts this year will keep the economy growing. American Express added 2.8%, while the SPDR S&P Regional Banking ETF gained nearly 3.4%.

- Alphabet, Amazon, Microsoft and Nvidia rose about 1%, while Meta Platforms gained 1.9%. Recent market laggards Apple and Tesla advanced 1.5% and 2.5%, respectively.

- Chipotle Mexican Grill gained 3.5% after declaring a stock split postmarket Tuesday. Paramount Global skyrocketed 11.8% following a report that Apollo Global Management offered $11 billion for its film and TV studio.

- Reddit power users balk at chance to participate in IPO as Wall Street debut nears.

CANADA MARKET

- Canada real estate: Affordability falls as income needed to buy a home increases.

- BoC expects to cut rates this year, governing council split on timing.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.