RESP Investment

Maximizing Government Education Subsidies – A Must-Read for Parents!

RESP is a Registered Education Savings Plan, a higher education subsidy program developed by the Canadian government. It aims to create an account for beneficiaries, who are youths under 17 years old and currently studying, to save for the expenses of completing higher education. As the contributions to the account accumulate interest and receive government grants, parents or subscribers who open an RESP account can significantly save on tuition fees.

Having an RESP investment account is a guarantee for a child's future education. As parents, we might cut costs in other areas, but education expenses for our children are non-negotiable.

Looking for advice?

We can help.

or call 647-323-3231 directly

How to open an RESP account

The steps are as follows:

- Apply for SIN for the beneficiary

- Select a financial institution for your RESP investment

- Provide beneficiary information and open the account in the beneficiary's name (remember to bring the SIN for the subscriber, the beneficiary's SIN, and the birth certificate).

- Apply for government grants or subsidies

- Make deposits

- Regularly check your account and verify the subsidy amounts received to ensure accurate disbursements.

The Do's and Don'ts of RESP Investments

Requirements for application

- When applying for an RESP investment account, the beneficiary must be:

- A Canadian resident and must be under 17 years of age.

- Have a Social Insurance Number (SIN).

- Preparing to attend an eligible post-secondary education program and requiring withdrawals from the RESP account to cover related expenses.

- If the beneficiary decides not to pursue higher education, the subscriber can:

Transfer the RESP account to another sibling.

If the subscriber or their spouse has available contribution room in their RRSP (Registered Retirement Savings Plan), funds can be transferred into the RRSP.

Take your time before withdrawing funds from the account while it's still valid. You can retain them temporarily to prevent any future needs. Typically, RESP accounts have a lifespan of 35 years.

If you wish to withdraw, you'll need to return the government grant portion to the government, and earnings will be subject to taxation plus a 20% penalty. Some RESP investment plans/types might have additional restrictions; it's advisable to inquire about these when opening the account.

- RESP contributions are limited to a lifetime maximum of $50,000 per beneficiary.

Type of RESP

Only by fully and comprehensively understanding all types of plans can you choose the RESP investment that truly suits your family.

- Individual Plan

In an Individual Plan, there can only be one beneficiary, and the beneficiary doesn't necessarily have to be related to the subscriber. In fact, the subscriber can even be the beneficiary themselves.

Advantages:

The subscriber has autonomy and can stop contributions at any time.

Disadvantages:

It significantly tests the subscriber's personal financial and investment capabilities.

- Family Plan

Suitable for families with multiple children, where the beneficiary must be a direct relative of the subscriber. If there are cousins among the beneficiaries, they cannot receive the grant.

Advantages:

You can purchase a Family Plan for multiple direct relatives. In case one of them doesn't attend university, the contributions can be redirected to other relatives. However, the total contribution for each beneficiary remains at $7,200 CAD

- Group Plan

Similarly, the subscriber can only designate one beneficiary, and there's no requirement for a blood relationship between the beneficiary and the subscriber.

The essence of a Group Plan is pooling together the RESPs of many beneficiaries born in the same year, managed by a professional organization. All beneficiaries share in the investment returns generated by the contributions.

The final amount received depends not only on the returns in the account but also on how many children eventually attend university.

Typically, such plans come with strict regulations. Late payments or stopping contributions might result in penalties, leading to partial or complete loss of investment returns in the account.

Benefits of RESP

Why choose RESP Investments?

- The account's investment benefits are tax-deferred, and accessing the returns often incurs lower or no taxes.

- It's not limited to tuition fees; the benefits can also be used for other related higher education expenses, such as book costs, student living expenses, and more.

- Access to government grants and subsidies, such as the Canada Education Savings Grant (CESG), which provides a lifetime maximum of $7,200 CAD in grant money.

- Extremely flexible usage: RESP subscribers and beneficiaries can be flexible, not necessarily having a parent-child relationship. Funds can be transferred to siblings, or even to parents' RRSP accounts.

How much government grant can I receive?

The government grants associated with an RESP investment account mainly consist of two types:

CESG, which stands for Canada Education Savings Grant, requires contributions to be eligible.

This grant is directly contributed by the government into the account and grows tax-free. The CESG matches contributions by 20% annually, up to a maximum of $500 per year. By investing $2,500 annually in an RESP, you can receive the maximum $500 government grant. The lifetime limit for CESG is $7,200.

Requirements for application:

- The beneficiary must be a Canadian resident.

- To open an RESP account, you need a Social Insurance Number (SIN).

- If the age is between 16-17 years old, there must be at least $2,000 in contributions made to the RESP account before the beneficiary turns 16, and these funds should not have been withdrawn.

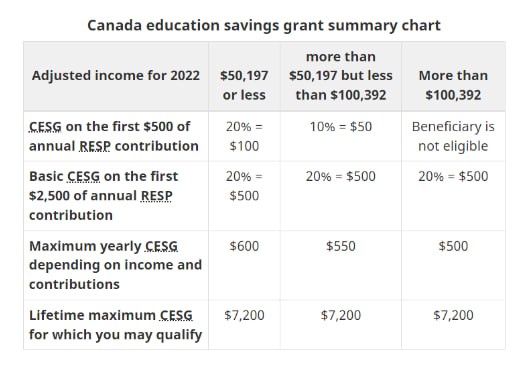

ACESG, short for Additional Canada Education Savings Grant, is available for families with incomes below a certain threshold. The government provides an extra 10% to 20% matching grant on the first $500 contributed annually, amounting to approximately $50 to $100. Below is the 2022 guideline:

CLB, which stands for Canada Learning Bond, is available without the need for contributions. It is an additional government grant provided to low-income families.

Compared to CESG, CLB doesn't require contributions. Families eligible for CLB can receive government funds by simply opening the account, even without any deposits. Upon the first account opening, families meeting the CLB eligibility criteria can receive $500. Additionally, they can get an extra $100 annually until the child turns 15. Similar to CESG, the investment returns for CLB also grow tax-free, with a lifetime limit of $2,000.

It's advisable to open an RESP education fund account for your child as early as possible because eligibility for CLB is based on family income. If you wait until your income increases before opening an RESP investment account, you might miss out on CLB eligibility.

Requirements for application:

- The beneficiary must be a Canadian resident.

- The beneficiary and the applicant have valid Social Insurance Numbers.

- The beneficiary must have been born after January 1, 2004.

- The family must be low-income (with an income below $47,630).

- The applicant's children are designated as beneficiaries for this RESP investment account.

RESP FAQs

- How to withdraw from an RESP? What are the requirements?

RESP withdrawals can be categorized into two situations:

A. If the beneficiary is attending a post-secondary education program, withdrawals can be used for tuition, transportation, accommodation, and related expenses. There might be an initial limit of $2,500 or $5,000 for the first withdrawal, but usually, subsequent withdrawals have no set limit.

B. If the beneficiary does not pursue post-secondary education, you can handle the funds in the account according to the options mentioned earlier. The grant money needs to be returned to the government.

- To receive the maximum CESG grant, consider contributing up to $2,500 annually, allowing you to obtain the maximum CESG amount of $500 per year.

The minimum monthly contribution is $208.33, or $2,500 annually. Any excess contributions won't receive government grants. Making contributions for 14 to 15 consecutive years allows for full CESG grant eligibility.

- Is there an age limit for RESP beneficiaries? What is it?

Yes, there are limitations. When opening the account, the beneficiary's age cannot exceed 17 years old. In a family plan, contributions can be made until the beneficiary turns 31. In an individual plan, contributions can continue for 31 years after the plan's inception, regardless of the beneficiary's age.

- Can the CESG grant be transferred to someone else?

Yes, the beneficiary can transfer an amount equal to the current year's maximum of $500 and the previous year's $500, making the maximum annual transferable amount $1,000.

During the investment process, the personal control one has is quite limited. It primarily relies on collaborating with professional investment advisors to select the most suitable RESP investment plans and benefit grants for greater profitability. That's why Ai Financial recommends seeking one-on-one consultations with our experts by clicking the button, for any inquiries you might have.

Start Saving Today

The choices for RESP investments are diverse. It's important to select suitable investment products and targets based on your financial situation and needs. If you have any questions about RESP investments, feel free to schedule a free one-on-one consultation with a professional advisor (via phone, Zoom, or in-person).

You can call+1 647-323-3231for more information.