Mar 21 | Daily Finance News

Post Views: 675

U.S. STOCK PICKS

- Stocks climbed Thursday and technology shares outperformed, adding to the previous session’s gains that led to new records on Wall Street. Thursday’s moves follow a winning day on Wall Street that sent the three major indexes to new closing highs, with the S&P 500 breaking above 5,200 for the first time.

- U.S. business activity held steady in March, but prices increased across the board, suggesting that inflation could remain elevated after picking up at the start of the year.

- Micron Technology jumped more than 14% on better-than-anticipated earnings and headed for its best day since December 2011. The news lifted other semiconductor stocks, with Nvidia and Advanced Micro Devices last up more than 1% each. Marvell Technology, Intel and Taiwan Semiconductor jumped about 3%. The VanEck Semiconductor ETF surged 2.5%.

- Meta Platforms, Microsoft and Amazon adding at least 1%.

- Elon Musk companies are gobbling up Nvidia hardware even as Tesla aims to build rival supercomputer.

- Reddit prices IPO at $34 per share in first major social media offering since 2019.

- February home sales spike 9.5%, the largest monthly gain in a year.

CANADA MARKET

- Federal minimum wage rising to $17.30 an hour on April 1.

- Deadlines, credits and life changes: the biggest tax pitfalls experts say to avoid.

Mar 21 | Daily Finance News

U.S. STOCK PICKS

Closing: 4:00 PM EST

Today's U.S. stock market saw gains across all three major indices. Dow closes more than 250 points higher as major averages surge to fresh records

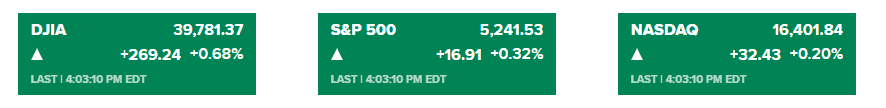

- The DJIA rose by 269.24 points, or 0.68%, closing at 39,781.37 points.

- The S&P 500 increased by 16.91 points, or 0.32%, closing at 5,241.53 points.

- The NASDAQ gained 32.43 points, or 0.20%, closing at 16,401.84 points.

- Apple bucked the broader tech-driven uptrend, slumping 4% after the Justice Department filed an antitrust lawsuit against the iPhone maker.

- Social media company Reddit surged more than 40% above its initial public offering price in its market debut.

- Prices are beginning to come down from peak highs for both new and used cars, but we might never go back to pre-pandemic norms, experts say.

- ESPN’s model is eroding. Past and present execs are split on how it can protect its dominance.

CANADA MARKET

- Bank of Canada says quantitative tightening should end in 2025.

- Canada plans to cut temporary residents by 20% over three years.

- Younger home buyers compromising to get into the market earlier include looking for smaller and smaller homes, purchasing homes they may not stay in over the longer term and expanding their location preferences.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.