Mar 25 | Daily Finance News

Post Views: 619

U.S. STOCK PICKS

Closing: 4:00 PM EST

- Stocks slipped Monday to start a shortened trading week as the rally that brought Wall Street to record levels took a breather.

- The Dow Jones Industrial Average fell 162.26 points, or 0.41%, closing at 39,313.64. The S&P 500 dipped 0.31% to finish at 5,218.19, while the Nasdaq Composite was down 0.27% and settled at 16,384.47.

- The market is on track for its fifth consecutive month of gains, with the major U.S. stock benchmarks crossing new all-time closing high levels last week. The S&P 500 added roughly 2.3% last week, while the Dow gained just under 2% for its best week since December, nearing the 40,000 level. The Nasdaq Composite, meanwhile, jumped about 2.9% during the period.

- This week, investors will gain further insight about the path of inflation from the February personal consumption expenditures price index, the Fed’s preferred inflation gauge, released Friday morning. The market’s reaction will be determined on the following Monday given the Good Friday holiday.

- FTX estate selling majority stake in AI startup Anthropic for $884 million, with bulk going to UAE.

- Lawsuit filed by Elon Musk’s X against nonprofit CCDH thrown out by judge on free speech grounds. Click to read AiF insight | Musk out of money? Funding chain broken?

- Nissan looks to address ‘extreme market volatility’ with 30 new models, EV cost cuts.

- Super Micro stock jumps after analysts at JPMorgan initiated coverage of the stock with an Overweight rating and a $1,150 price target.

CANADA MARKET

- Bell CEO ordered to appear at House of Commons committee over job cuts.

- Keith Creel, CEO of Canadian Pacific Kansas City Ltd., sees his compensation jump to $20 million after railway merger.

- Higher chocolate prices part of wider trend as climate, other factors disrupt supply.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

Mar 25 | Daily Finance News

U.S. STOCK PICKS

- Stocks slip to start shortened trading week as rally to records pauses.

- Shares of Intel led the market lower, with the semiconductor firm sliding 4% after The Financial Times reported that new China guidelines would block Intel chips in government servers and computers.

- United Airlines stock fell 4% after the Federal Aviation Administration said it would be heightening scrutiny of the airline after a series of safety incidents.

- Boeing CEO to step down in broad management shake-up as 737 Max crisis weighs on aerospace giant.

- EU launches probe into Meta, Apple and Alphabet under sweeping new tech law.

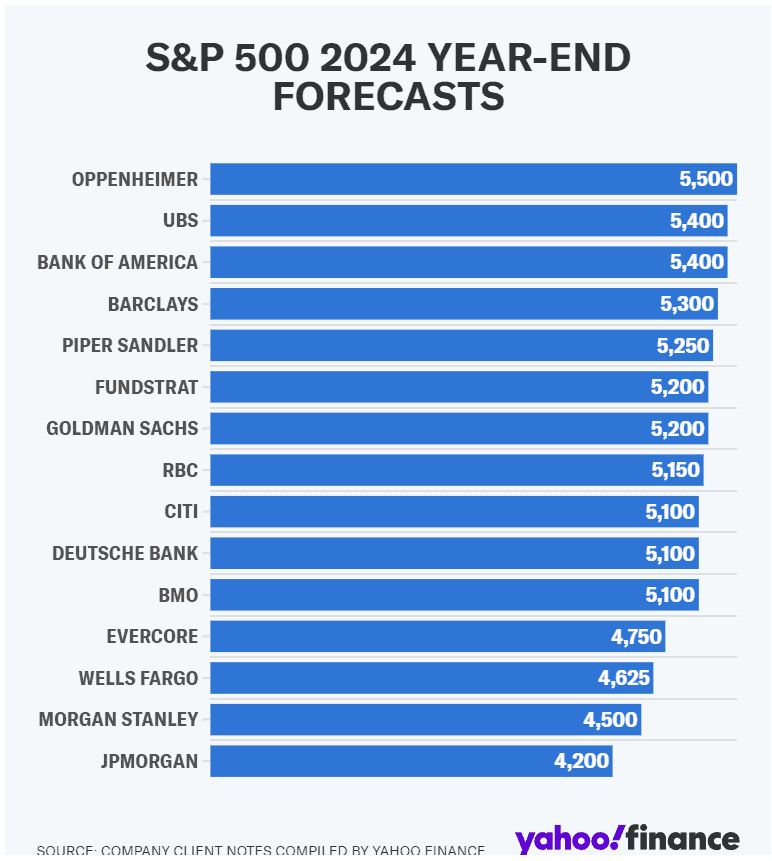

- Wall Street just gave its highest year-end forecast yet for the S&P 500.

CANADA MARKET

- Canada government spending growing twice the pace of revenue.

- Canada's economy to slow with new limits on temporary migrants: Canada’s planned reduction in temporary residents is set to add downward pressure to inflation and economic growth in the coming months, and the policy will likely halve its population growth rate when it takes full effect next year, economists say.

- More Canadians ditch traditional TV as streamers are 'winning the battle': report

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.