周三,标普500指数和纳斯达克综合指数再...

Read MoreCategories

Recent Posts

- S&P 500跃升1%,创下历史新高收盘,首次收盘超过5300点 | Ai Financial 财经日报 May 15, 2024

- 解读华尔街谚语-Sell in May and Go Away? | Ai Financial 基金投资 May 15, 2024

- AiF观点 | 三大股指再创新高!你在市场里么? May 15, 2024

- 标普500和纳斯达克在消费者通胀报告发布后上涨至历史新高 | Ai Financial 财经日报 May 15, 2024

- AiF观点 | 市场:美联储不降息?那我们涨吧! May 14, 2024

- 消费者通胀报告公布前夕,纳斯达克指数创下历史新高收盘 | Ai Financial 财经日报 May 14, 2024

- AiF观点 | 今天凌晨,美国动手啦! May 14, 2024

- AiF观点 | 美联储还没打算降息,加拿大已经挺不住了 May 14, 2024

- 最新的美国通胀数据发布后,股市小幅上涨 | Ai Financial 财经日报 May 14, 2024

- 道指连续八个交易日上涨后首次下跌,因消费者对通胀预期上升 | Ai Financial 财经日报 May 13, 2024

- AiF观点 | 又一家价格超过价值的公司下市了 May 13, 2024

- 【Weekly recap】 Rising earnings keep the bull market intact; Inflation data remains in focus May 13, 2024

- AiF insight | GameStop, Game start? again? May 13, 2024

- Wall Street hovers on the brink of reaching new highs. May 13, 2024

- The Dow Jones continues its eighth straight day of gains, with the S&P 500 edging back towards record highs. May 10, 2024

- AiF insight | Will Canada Cut Interest Rates in June? May 10, 2024

- AiF insight | What Is a Dead Cat Bounce in the Stock Market? May 10, 2024

- AiF观点 | 股市连续涨8天了, 又一批人踏空了! May 10, 2024

- 华尔街上涨,迈向又一个胜利周的收官 | Ai Financial 财经日报 May 10, 2024

- 道琼斯指数收盘上涨逾300点,连续第7个交易日收涨 | Ai Financial 财经日报 May 9, 2024

U.S. STOCK PICKS

Closing: 4:00 PM EST

- Stocks closed higher Monday, lifted by Tesla, while traders geared up for a week dominated by corporate earnings and a Federal Reserve meeting.

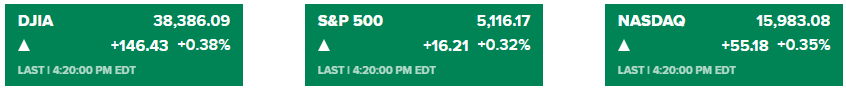

- The S&P 500 rose 0.32% to 5,116.17, while the Nasdaq Composite added 0.35% to 15,983.08. The Dow Jones Industrial Average added 146.43 points, or 0.38%, to end at 38,386.09.

- Tesla jumped more than 15%, providing upward momentum to the market after clearing a key hurdle for full self-driving technology in China.

- Apple climbed around 2.5% on the heels of a bullish upgrade from investment firm Bernstein. But those gains were somewhat mitigated as Big Tech peers Microsoft, Alphabet and Meta all finished lower.

- Morgan Stanley, which led the Reddit and Astera Labs IPOs, expects 10 to 15 more tech offerings this year and a “better year” in 2025.

- The S&P 500 fell as much as 5.5% during the month as signals of stubbornly high inflation forced traders to ratchet back expectations for when the Federal Reserve could begin easing interest rates.

- After coming into the year forecasting six or more cuts to rates this year, traders are now placing many bets on just one, according to data from CME Group.

- When the Federal Reserve announces its latest policy decision on Wednesday, no one expects it to move its main interest rate, which is sitting at its highest level since 2001. Instead, the hope is that the central bank could offer some clues about when the first cut to rates could come.

U.S. STOCK PICKS

- The S&P 500 edged higher on Monday, lifted by gains in some megacap technology stocks as traders entered a week dominated by corporate earnings and a Federal Reserve meeting.

- Tesla jumped more than 11% after clearing a key hurdle for full self-driving technology in China.

- Apple climbed more than 3% on the heels of a bullish upgrade from investment firm Bernstein.

- On the other hand, Microsoft, Alphabet, Meta and Nvidia all traded lower.

- Domino’s Pizza popped more than 4% after reporting that per-share earnings topped analysts’ expectations.

- Beyond Domino’s, Apple, McDonald’s, Coca-Cola and Amazon are also among the major companies sharing quarterly financials this week.

- Amazon says more packages are arriving in a day or less after hefty investment in speedy fulfillment.

- It is shaping up to be a strong earnings season. Of the more than 45% S&P 500-listed firms that have posted results so far, about 4 out of every 5 have surpassed expectations, according to FactSet.

- Monday’s action follows a positive — albeit rocky — week on Wall Street, marking a reprieve from the recent market downtrend. Still, the S&P 500 and Nasdaq are on track to end April down more than 2%, while Dow is poised to slide more than 3%.

- Monetary policy will take center stage later in the week, with the Fed set to release its latest interest rate announcement on Wednesday. While the central bank is widely anticipated to keep the borrowing cost unchanged, investors will still closely monitor the post announcement press conference with Chair Jerome Powell.

CANADA MARKET

- GDP report

Statistics Canada will release February figures for gross domestic product on Tuesday. The agency's advance estimate for the month indicated that real GDP rose 0.4 per cent, helped by strength in mining, quarrying, and oil and gas extraction, manufacturing, and finance and insurance, partially offset by decreases in utilities. - Loblaw earnings

Grocery and drugstore retailer Loblaw Cos. Ltd. will report its first-quarter results on Wednesday morning. The earnings come as the company, which has faced sharp criticism from shoppers trying to manage the increased cost of groceries, has been expanding its footprint of discount stores. - Bank of Canada

Bank of Canada governor Tiff Macklem and senior deputy governor Carolyn Rogers will be on Parliament Hill this week. The pair will be at the Senate committee on banking, commerce and the economy on Wednesday afternoon followed by the House of Commons finance committee on Thursday morning. - Gildan and Parkland

A pair of Canadian companies — Gildan Activewear Inc. and Parkland Corp. — that are both facing unhappy shareholders will report their quarterly results after the close of trading Wednesday. Gildan is embroiled in a dispute with an activist shareholder who is seeking to replace a majority of the company's board in a bid to bring back Glenn Chamandy as chief executive. Meanwhile, the largest shareholder at Parkland is calling for the company to undertake a review of strategic alternatives including a possible sale. - Air Canada results

Air Canada will report its first-quarter results on Thursday morning. The report could give an indication of how well Canadians' penchant for post-pandemic travel has held up after the airline reported record full-year operating revenue for 2023, reflecting strong demand for air travel.

*All information sourced from news portals such as CNBC, Yahoo Finance, Reuters, etc.

RELATED READING

Subscribe to Ai Financial Newsletter

Sign up for our weekly stock market update and be the first to know about our webinars.