How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Markets Decline as Inflation Data Sparks Fed Policy Debate

Market Overview:

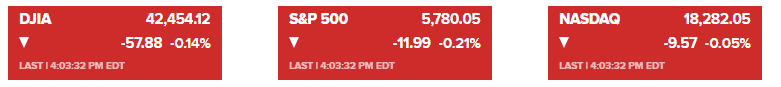

Stocks fell on Thursday, with the S&P 500 and Dow Jones Industrial Average retreating from record highs. The S&P 500 lost 0.4%, the Dow declined by 179 points (0.4%), and the Nasdaq dipped 0.3%. Wall Street reacted to September’s Consumer Price Index (CPI) report, which showed a 0.2% monthly increase, pushing the annual inflation rate to 2.4%, slightly above the 2.3% expected by analysts. This marks the lowest year-over-year inflation rate since February 2021.

The CPI data sparked renewed concerns that the Federal Reserve may slow the pace of future rate cuts. Atlanta Fed President Raphael Bostic mentioned he would support a pause in November’s rate meeting, despite market expectations for another 25 basis point reduction. Traders are now pricing in an 80% chance of a quarter-point cut in November, according to CME Group’s FedWatch tool.

Minutes from the Fed’s latest meeting also revealed some division among officials, with a substantial majority supporting a rate cut, though some favored a smaller reduction. Economists now see the Fed facing the challenge of reducing inflation while avoiding a recession. Bond traders are betting that the central bank will lower rates by 25 basis points at the next meeting in November.

Corporate News:

- Universal Insurance: Shares surged 10%, benefiting from Hurricane Milton’s impact in Florida.

- Pfizer Inc.: The stock dropped 2% after activist investor Starboard Value accused Pfizer of threatening legal action against two former top executives.

- Advanced Micro Devices (AMD): AMD slipped 1.5% after introducing a new AI chip designed to compete directly with Nvidia’s offerings.

- Delta Air Lines Inc.: Delta reduced its profit and sales forecast for the remainder of the year, indicating a slow recovery from a challenging summer travel season.

- Domino’s Pizza Inc.: Domino’s cut its 2024 sales growth and new location projections, citing a slowdown in consumer spending affecting the restaurant industry.

- GXO Logistics Inc.: GXO, the supply-chain services company that spun off from XPO Inc., is exploring a potential sale, according to people familiar with the matter.

- Eli Lilly & Co.: Eli Lilly is intensifying its legal campaign against companies that temporarily produced and sold copycat versions of its weight-loss drugs during a US shortage that ended last week.

- Toronto-Dominion Bank (TD): TD Bank agreed to pay nearly $3.1 billion in fines and penalties and will face a cap on its US retail banking assets after pleading guilty to failing to prevent money laundering by drug cartels and other criminals.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More