How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Jumps 400 Points to Record, S&P 500 Closes Above 5,800 as Wall Street Banks Reach Two-Year High

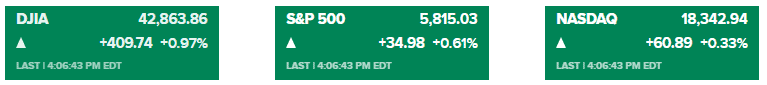

Market Overview:

Stocks surged on Friday as the S&P 500 and Dow Jones Industrial Average reached new highs, driven by a strong start to the third-quarter earnings season from major banks. The S&P 500 climbed 0.7%, the Dow gained 440 points (1%), and the Nasdaq rose 0.45%, leaving it less than 2% below its all-time high.

Investor optimism grew as banks exceeded expectations. JPMorgan Chase rose 4.4% after reporting higher-than-expected profits and revenue, while Wells Fargo increased 5.6% despite an 11% decline in net interest income. Analysts suggested this signals resilience in the banking sector, contributing to broader market gains.

Economic data also played a role in the positive sentiment, with a cooler-than-expected September producer price index easing concerns about persistent inflation. This, combined with moderate consumer price index growth, hinted that the Federal Reserve could achieve its 2% inflation target while keeping interest rates steady.

The Federal Reserve’s rate outlook continues to dominate market focus, with futures now indicating an 86% probability of a quarter-point rate cut in November. Investors remain cautious about future data releases, which could further impact rate expectations.

Corporate News:

- JPMorgan Chase & Co.: Shares jumped 4.4% following a strong earnings report, with profits and revenues surpassing expectations.

- Tesla Inc.: Shares dropped 8.8% following a disappointing robotaxi event that failed to meet investor expectations.

- Wells Fargo & Co.: The stock surged 5.6% as the bank posted solid profits despite a decline in net interest income.

- Tesla Inc.: Tesla shares dropped 8.8% after the company’s robotaxi event lacked the excitement investors anticipated.

- BlackRock Inc.: The world’s largest asset manager hit an all-time high of $11.5 trillion in assets under management, boosted by a record $221 billion in new client funds.

- Bank of New York Mellon Corp.: Third-quarter profits exceeded estimates, thanks to a rise in asset values that drove a 5% increase in fee revenue.

- BP Plc: BP expects its net debt to increase due to lower refining margins and delays in asset sales.

- Boeing Co.: Boeing is facing increasing pressure from its labor strike, which has entered its fourth week, as the company files charges of unfair labor practices against the union.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More