How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Stocks Retreat as Nvidia and ASML Weigh Down Markets, Dow Drops 300 Points

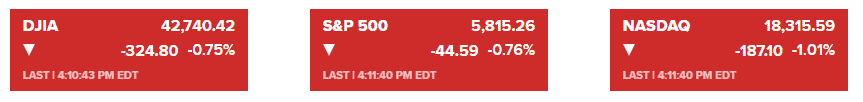

Market Overview:

Stocks fell on Tuesday as traders processed mixed corporate earnings and renewed concerns over semiconductor sales. The Dow Jones Industrial Average lost 324.80 points, or 0.75%, to close at 42,740.42, while the S&P 500 declined 0.76% to 5,815.26, and the Nasdaq Composite dropped 1.01% to 18,315.59.

Semiconductor companies led the decline, with ASML Holdings NV plunging 17% after issuing a surprise guidance cut, and further pressure came from Nvidia, down 5%, and AMD, which slipped 4.5%. This sector has been hit by both a cautious recovery outlook and concerns over tighter U.S. restrictions on AI chip sales. The VanEck Semiconductor ETF fell 5.4%, marking its worst performance since September.

On the economic front, Treasury yields fell as the 10-year yield declined six basis points to 4.04%. Oil prices plunged 5%, driven by easing concerns about a potential disruption to Iran’s oil supply after reports indicated Israel might not target Iranian crude infrastructure. Despite these declines, analysts remain optimistic about the broader market’s resilience amid strong third-quarter earnings results.

Corporate News:

- ASML Holding NV: The semiconductor firm saw shares drop 17% following a surprise reduction in its outlook, prompting a broader selloff in the tech sector.

- Nvidia and AMD: Both companies were caught in the semiconductor selloff, with Nvidia falling 5% and AMD dropping 4.5%, driven by news of possible U.S. restrictions on AI chip sales to specific countries.

- Boeing Co.: Boeing is preparing to raise up to $25 billion in funding to navigate a series of operational setbacks and ongoing strikes.

- UnitedHealth Group Inc.: Shares fell 8.1% after the company cut its full-year earnings outlook, weighing heavily on the Dow.

- Johnson & Johnson: The healthcare giant exceeded earnings expectations for the third quarter, driven by robust sales of its cancer drug Darzalex.

- PNC Financial Services: Surpassed net interest income expectations, reporting another strong quarter of sequential growth.

- Walgreens Boots Alliance: Announced plans to close 14% of its U.S. stores in a cost-cutting measure amid weakening consumer demand.

- LVMH: Fashion and leather goods sales fell for the first time since the pandemic, driven by reduced demand from Chinese consumers.

- Adidas AG: The company raised its annual profit forecast for the third consecutive quarter, citing sustained demand for retro sneakers and successful sales of its Yeezy inventory.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More