How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Hits Record, Nasdaq Rises as Chipmakers Rally; Fed Cut Hopes Fade

Market Overview:

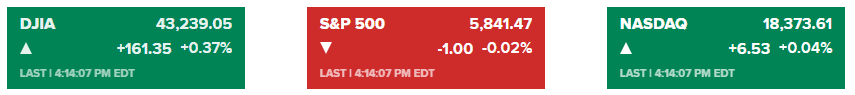

U.S. stocks had mixed results on Thursday as strong economic data fueled optimism about the resilience of the economy, despite some investors trimming their expectations for Federal Reserve rate cuts this year. The Nasdaq Composite rose 0.04% to 18,373.61, led by gains in semiconductor stocks, while the S&P 500 slipped 0.02% to 5,841.47 after hitting a new intraday record earlier in the day. The Dow Jones Industrial Average gained 161 points, or 0.37%, closing at 43,239.05.

Chip stocks saw a rebound, driven by Nvidia’s 2% rise to a new all-time high, bolstered by strong earnings and revenue forecasts from Taiwan Semiconductor Manufacturing Co. (TSMC), which surged 11%. Advanced Micro Devices (AMD) also gained 1%.

On the economic front, September retail sales rose 0.4%, beating expectations of a 0.3% increase. Excluding autos, sales were up 0.5%, well above the forecast of 0.1%. Weekly jobless claims also came in lower than expected, underscoring the ongoing strength of the labor market. This data followed stronger-than-expected inflation and employment reports earlier this month, leading some investors to question the likelihood of aggressive Fed rate cuts in November.

Treasury yields rose, with the 10-year yield climbing seven basis points to 4.09%, as traders reevaluated the timeline for future rate cuts. Swap contracts now price in 41

Corporate News:

- Allstate Corp. reported $630 million in losses due to Hurricane Helene in September.

- Amazon Web Services, a division of Amazon.com Inc., announced that new systems running Nvidia’s Blackwell chips won’t be available until early next year.

- Boeing Co. filed plans to sell up to $25 billion in equity and bonds, though clearance from regulators is still pending.

- CSX Corp. received a subpoena from the SEC concerning accounting errors and non-financial performance metrics.

- Deere & Co. is under investigation by the U.S. Federal Trade Commission for potential violations related to its agricultural equipment repair practices.

- Expedia Group Inc. rallied after reports that Uber Technologies Inc. had explored acquiring the travel-booking company.

- Blackstone Inc. saw profit increases driven by strong investor cash inflows into its credit arm, making it the firm’s largest division by assets.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More