How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Drops 400 Points Amid Tech Selloff and Rising US Yields

Market Overview:

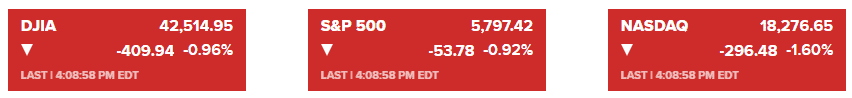

On Wednesday, U.S. stocks experienced sharp declines as rising Treasury yields weighed on investor sentiment. The Dow Jones Industrial Average fell 409.94 points (0.96%) to 42,514.95, marking its worst day since early September. The S&P 500 dropped 0.92%, closing at 5,797.41, while the Nasdaq Composite tumbled 1.6% to 18,276.65. Both the Dow and S&P 500 saw their third consecutive day of losses.

Treasury yields continued their upward trend, with the 10-year yield reaching 4.25%, its highest level since July 26. The yield has risen by 44 basis points in October alone, reflecting concerns about the Federal Reserve’s monetary policy and potential future fiscal deficits. Analysts believe higher rates could lead to further repricing across different sectors of the economy. This, coupled with fears of recession, has created a fragile market environment.

Large-cap stocks, particularly in the technology sector, faced significant pressure. Apple, Nvidia, Meta, Netflix, and Amazon all suffered losses of over 2%, with Apple declining 3%. Investors remain cautious as the upcoming weeks bring key tech earnings reports, the U.S. election, and further Federal Reserve meetings.

In the bond market, the cost of hedging against Treasury losses reached a yearly high. Rising options prices signal concerns that losses in bonds may deepen. Meanwhile, there is still uncertainty over the number of rate cuts the Fed will make by the end of the year.

Corporate News:

- McDonald’s Corp. fell over 4% following an announcement from the U.S. Centers for Disease Control and Prevention linking an E. coli outbreak to its Quarter Pounder burgers, leading to hospitalizations and one death.

- Nvidia Corp. led the decline in large-cap stocks, with shares down 3%. Investors are monitoring Apple closely after reports of iPhone 16 order cuts by about 10 million units for the fourth quarter and early 2025.

- Boeing Co. slipped after acknowledging ongoing operational issues that may take time to resolve.

- Qualcomm Inc. shares dropped after Arm Holdings Plc revoked a key intellectual property license.

- AT&T Inc. exceeded expectations for mobile subscriber growth in the third quarter.

- Hilton Worldwide Holdings Inc. revised its profit outlook downward, citing weaker travel demand.

- Coca-Cola Co. declined as investors questioned the company’s ability to continue raising prices amid slowing sales growth.

- Spirit Airlines Inc. surged after reports suggested Frontier Group Holdings is considering a renewed bid for the company.

- Deutsche Bank AG announced it will need to set aside more funds for bad debt, marking its second such revision this year.

- Kering SA, owner of luxury brand Gucci, warned of falling annual profits due to a slowdown in Chinese demand.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More