How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Rises Over 250 Points as Softening Oil Prices Boost Stocks

Market Overview:

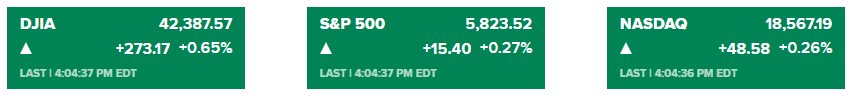

Stocks saw gains Monday, spurred by optimistic anticipation of upcoming mega-cap tech earnings and a reduction in geopolitical concerns. The S&P 500 increased by 0.27%, closing at 5,823.52; the Dow Jones Industrial Average advanced 0.65% to 42,387.57; and the Nasdaq climbed by 0.26%, finishing at 18,567.19. Recent weekend airstrikes by Israel on Iran steered clear of oil and nuclear facilities, alleviating some concerns in the energy sector and leading to a 6% drop in U.S. crude futures.

Investors are closely watching for earnings reports from five of the “Magnificent Seven” companies—Alphabet, Microsoft, Meta Platforms, Amazon, and Apple—alongside essential economic data releases, including the third-quarter GDP estimate and September PCE index. The outcome of these reports, alongside the upcoming U.S. presidential election and Federal Reserve meeting next week, are expected to guide market sentiment.

Additionally, demand for U.S. Treasuries weakened, driving yields up as investors eye the upcoming debt issuance. Pre-election market stability has been notable, with the S&P 500 yet to show any 1% daily shifts this October. If this persists, it will be the first October without a major swing since 2017, and the first in an election year since 1968.

Corporate News:

- Apple Inc. has initiated the release of its Apple Intelligence features and introduced a new 24-inch iMac, equipped with an AI-centric M4 processor, signaling a shift towards more advanced technology in their devices.

- Meta Platforms Inc. is reportedly developing a new search engine tailored to work with its AI chatbot, providing users with broader online search capabilities.

- McDonald’s Corp. experienced a significant decline in sales due to an outbreak of E. coli infections linked to its Quarter Pounders.

- Boeing Co. launched an almost $19 billion share sale to strengthen liquidity amid challenging financial conditions and to prevent a potential credit rating downgrade.

- Estée Lauder Cos. appointed Stéphane de La Faverie as its new CEO, according to sources cited by the Wall Street Journal.

- Volkswagen AG announced intentions to close at least three factories and implement widespread wage reductions and job cuts to combat financial strain, with a primary focus on its German operations.

- Johnson & Johnson is preparing for a high-stakes trial in January, a crucial step in its strategy to address ongoing cancer lawsuits associated with its baby powder products through bankruptcy court

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More