How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Nasdaq Hits Record High as Major Tech Stocks Rally Ahead of Earnings

Market Overview:

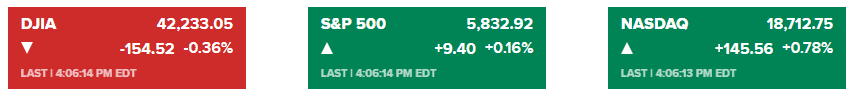

On Tuesday, the Nasdaq Composite rose 0.9% to reach a new record high, surpassing the 18,700 level, supported by gains in major tech stocks ahead of key earnings releases. Alphabet, Snap, Reddit, Chipotle, and Advanced Micro Devices were set to report quarterly results after the close, with Meta Platforms and Microsoft scheduled for Wednesday and Apple on Thursday. This wave of tech earnings is expected to reveal if long-term growth trends hold steady, though concerns over potential antitrust costs may cloud Alphabet’s outlook. The S&P 500 advanced by 0.3%, while the Dow Jones Industrial Average underperformed with a 0.2% drop, trailing other indices.

This week marks the peak of the earnings season, with over 150 companies from the S&P 500 slated to report by Friday. Investors are looking to earnings growth to support elevated market valuations, with tech stocks leading in expectations. Meanwhile, the 10-year Treasury yield climbed to its highest since July, signaling that the fixed-income market remains cautious about economic volatility as the Federal Reserve’s upcoming decision approaches.

In broader economic data, U.S. job openings declined to their lowest level since early 2021, slightly offsetting September’s robust employment figures and leading traders to lower expectations for additional rate cuts. Consumer confidence also rose, marking its highest point since the beginning of the year. Bitcoin saw a notable rise as well, surpassing $72,000 for the first time since April.

Corporate News:

- Apple Inc. redesigned its Mac mini for the first time in nearly 15 years, reducing its size to 5 inches and upgrading it with faster M4 chips.

- McDonald’s Corp. reported third-quarter sales below Wall Street expectations, largely due to sluggish performance in markets like France, China, the UK, and the Middle East.

- Royal Caribbean Cruises Ltd. raised its earnings outlook for the fourth time this year, expecting strong demand to persist.

- JetBlue Airways Corp. provided a weaker-than-expected sales forecast, signaling a longer recovery period.

- Ford Motor Co. warned that its earnings would be at the lower end of forecasts, impacted by high warranty costs.

- PayPal Holdings Inc. missed analyst expectations for its fourth-quarter revenue forecast.

- B. Riley Financial Inc. finalized its second deal in less than a month, raising $236 million by divesting rights to its portfolio of consumer brands, aiming to reduce debt.

- SoFi Technologies Inc. saw third-quarter earnings and a profit forecast beat expectations, although not enough to extend the company’s recent stock rally.

- Crocs Inc. revised its growth forecast downward, anticipating declines in its HeyDude casual brand sales.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More