How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Soars Nearly 300 Points to Start November Despite Weak Jobs Report

Market Overview:

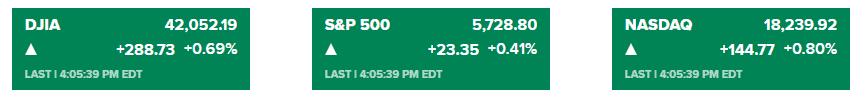

Stocks rallied on Friday, marking a strong start to November as dip buyers stepped in, looking past a disappointing jobs report. The Dow Jones Industrial Average gained 288.34 points, or 0.69%, while the S&P 500 advanced 0.41%, and the Nasdaq Composite rose 0.8%. This positive momentum was driven primarily by significant gains in major technology stocks, which have been pivotal in lifting overall market sentiment.

Amazon led the charge, surging 6.5% after reporting strong earnings, particularly in its cloud and advertising sectors. Intel also contributed to the bullish sentiment with an 8.5% jump following its robust revenue forecast. These gains helped offset earlier declines in the S&P 500 and Nasdaq, which had been pulled lower by disappointing earnings from companies like Microsoft and Meta Platforms.

Despite the positive market performance, a jobs report released on Friday revealed that the U.S. economy added only 12,000 jobs in October, a significant drop from the expected 100,000 and marking the slowest pace of job growth since December 2020. The unemployment rate held steady at 4.1%, aligning with estimates. Analysts attributed the weak jobs figures to external factors, including hurricanes and strikes, suggesting that the underlying labor market remains resilient.

Traders did not react strongly to the jobs data, viewing it as noise rather than a signal of an impending economic downturn. Many analysts believe that the Federal Reserve is likely to continue its easing cycle, with expectations for a 25 basis point rate cut in the upcoming meetings. Investor focus is also on the U.S. presidential election on November 5, which is expected to contribute to market volatility.

Overall, the market’s strong start to November comes on the heels of a difficult October, where the Dow fell 1.3%, and the S&P 500 and Nasdaq experienced declines of 1% and 0.5%, respectively. As the week wrapped up, the S&P 500 managed to trim its losses and halt a two-day downturn, bolstered by solid performance from industry bellwethers and megacap technology stocks.

Corporate News:

- Dish Network Corp. creditors plan to reject the revised bond-exchange offer necessary for the company’s proposed acquisition by rival DirecTV.

- B. Riley Financial Inc. has agreed to sell part of its wealth-management business to Stifel Financial Corp. for up to $35 million, continuing its strategy to stabilize the struggling investment firm.

- BYD Co. began the final quarter of the year with record monthly sales, demonstrating strong performance during a peak season for auto purchases in China.

- Charter Communications Inc. shares surged after the company reported a smaller loss of broadband subscribers than analysts had anticipated in the third quarter, despite the end of a federal internet subsidy program.

- Reckitt Benckiser Group Plc jumped following a US jury verdict that cleared it and Abbott Laboratories of claims regarding undisclosed risks associated with their premature-infant formulas.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More