This post outlines various RRSP investment options for Canadians in...

Read MoreMarkets Wrap: Dow Drops Over 200 Points as Wall Street Shuns Risk Ahead of Tight Election

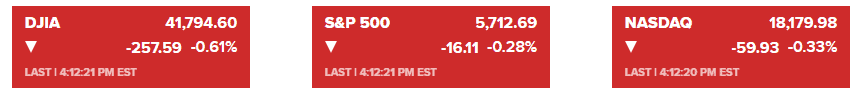

Market Overview:

Stocks struggled to maintain stability on Monday as investors prepared for the U.S. presidential election and an anticipated Federal Reserve rate cut later this week. The Dow Jones Industrial Average fell by 258 points (approximately 0.6%), while both the S&P 500 and Nasdaq Composite declined about 0.3%. The Dow briefly dropped over 400 points during the session, with the S&P 500 and Nasdaq fluctuating between gains and losses.

Upcoming election results are expected to significantly influence market trends as polls indicate a tight race between former President Donald Trump and Vice President Kamala Harris. Investors are trying to gauge the potential implications of a divided Congress on future legislative changes. Meanwhile, the market is also bracing for the Federal Reserve’s decision on interest rates on Thursday, with traders estimating a 98% probability of a quarter-point cut.

In the lead-up to the election, safe-haven U.S. Treasurys rallied, with the benchmark 10-year Treasury yield dropping to approximately 4.31%. The overall market sentiment reflects caution amid heightened volatility, with options markets indicating a defensive stance among investors. As equity markets prepare for significant events this week, analysts anticipate the S&P 500 may see positive returns following Election Day, historically reflecting an upward trend in years past.

Corporate News:

- Berkshire Hathaway Inc. reported a record cash pile of $325.2 billion for the third quarter, as Warren Buffett reduced his stake in Apple Inc. by about 25%, with its value falling from $84.2 billion to $69.9 billion.

- Nvidia Corp. will replace Intel Corp. in the Dow Jones Industrial Average, effective November 8, as it continues to lead the AI sector, boasting a 180% increase year-to-date.

- PACS Group Inc. shares dropped sharply following a short report by Hindenburg Research alleging the company engaged in fraudulent activities against taxpayers.

- Franklin Resources Inc. saw its shares decline amid an investigation by the Commodity Futures Trading Commission into trades at its Western Asset Management Co. unit, which experienced an $18 billion outflow of long-term cash last month.

- Uber Technologies Inc. plans to propose a reduction in the base pay rate for New York City drivers to lower ride prices in the city.

- Viking Therapeutics Inc. experienced a surge in shares following promising data regarding its obesity pill, which could compete with leading products from Eli Lilly & Co. and Novo Nordisk A/S.

- Peloton Interactive Inc. received a rare buy rating from Bank of America Corp., which upgraded the company’s stock by two notches, citing a favorable profit outlook under its new CEO.

- Talen Energy Corp. and other power company stocks fell after regulators rejected Talen’s proposal to supply a data center.

- BCE Inc. has agreed to acquire an internet provider in the Pacific Northwest as part of its strategy for growth in the U.S. market.

- Carrefour SA is exploring options to enhance its valuation, three years after failed sale discussions with an industry competitor.

- AstraZeneca Plc announced that its experimental obesity pill showed good tolerance among type-2 diabetes patients, presenting favorable results from several studies.

- Commerzbank AG’s CEO, Bettina Orlopp, is advocating for capital optimization in light of a potential acquisition attempt by UniCredit SpA, emphasizing the importance of maintaining independence.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Defense Stocks Are a ‘Mega Force.’ NATO, New Tech Make the Case| AiF insight

Driven by rising geopolitical tensions and the race for AI...

Read MoreBond King Bill Gross Predicts a “Little Bull Market” for Stocks and a “Little Bear Market” for Bonds| AiF insight

Renowned bond investor Bill Gross recently issued a new warning:...

Read MoreCanada, Brace for a “Decade of Austerity”| AiF insight

Inflation Eroding Savings, Debt Pressures Mount, Retirement Becomes a Luxury...

Read More