How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Soars 1,500 Points to Record High as S&P 500 Marks Best Post-Election Day

Market Overview:

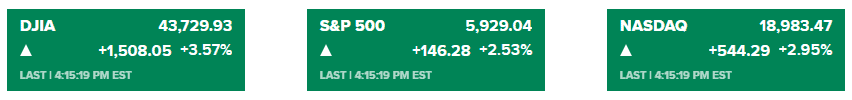

On Wednesday, U.S. stocks soared to record highs as investors reacted to Donald Trump’s victory in the 2024 presidential election. The Dow Jones Industrial Average surged 1,508 points, marking a 3.6% increase and reaching an all-time high. The S&P 500 and Nasdaq Composite also set new records, rising 2.5% and nearly 3%, respectively.

NBC News projects Trump’s win with at least 291 Electoral College votes, securing victories in key swing states like Pennsylvania, North Carolina, and Georgia. The results boosted stocks expected to benefit from Trump’s policies, including Tesla (up 14%), JPMorgan Chase (up 11.5%), and Wells Fargo (up 13%). The small-cap Russell 2000 index also jumped 5.8%, as smaller, U.S.-focused companies are projected to benefit from Trump’s tax cuts and protectionist agenda.

The dollar index rose to its highest level since July, driven by expectations that Trump’s proposed tariffs would strengthen the currency. Meanwhile, Bitcoin reached a record $75,000, fueled by optimism around potentially relaxed regulations under the Trump administration. Treasury yields also climbed, with the 10-year yield reaching 4.45%, as investors anticipate economic growth under Trump’s fiscal policies, which include tax cuts and increased spending.

Republicans are expected to regain control of the Senate, with the House still contested. A “red sweep” could lead to substantial changes in fiscal policy, including possible corporate tax cuts and deregulation that favor domestic growth. Analysts expect this political alignment to drive sustained market gains, with particular growth in financials, industrials, and energy sectors.

Markets responded positively, with investor sentiment favoring pro-growth policies and potential M&A activity. The S&P 500, Nasdaq, and Dow all showed strong performances, with trading volumes significantly above average. The drop in the VIX, Wall Street’s “fear gauge,” indicates lower volatility, signaling optimism among investors.

With the election outcome confirmed, attention now shifts to the Federal Reserve’s upcoming meeting, where another interest rate cut is anticipated.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More