How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Closes Above 44,000 for the First Time Amid Trump Rally

Market Overview:

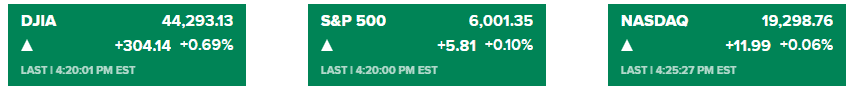

The Dow Jones Industrial Average surged over 300 points on Monday, closing at a record 44,293.69 and marking the first time it has crossed the 44,000 mark. This 0.69% gain followed a strong postelection rally, fueled by optimism over the potential regulatory changes expected under President-elect Trump. Meanwhile, the S&P 500 inched up by 0.1% to a record 6,001.35, and the Nasdaq Composite was nearly flat, gaining a modest 0.06% to 19,298.76. Small-cap stocks, represented by the Russell 2000, led with a 1.5% increase, achieving their highest level since 2021.

Economic growth-oriented stocks outperformed, particularly in the banking sector, with JPMorgan Chase, Goldman Sachs, Bank of America, and Citigroup all showing gains. Despite some selling pressure on large tech stocks, such as Apple, Microsoft, and Amazon, Tesla rose sharply by over 9%, continuing its postelection rally. Bitcoin also surged, surpassing $87,000, which buoyed cryptocurrency-related stocks like Coinbase and Mara Holdings, up by 20% and 30%, respectively.

The election week’s gains continue as investors shift portfolios, focusing on economic growth sectors and anticipating a potential softening of regulations in banking and other industries. Inflation data due this week could impact market momentum, with the core CPI expected to reveal October’s price pressures, influencing the Fed’s outlook on reaching its inflation target.

Corporate News:

- Nvidia Corp. was promoted to the top large-cap pick at Piper Sandler due to its leading role in AI accelerators and the anticipated release of its Blackwell chip.

- Cigna Group confirmed it would not pursue a merger with Humana Inc. after reports of potential renewed discussions.

- AbbVie Inc. shares declined significantly following the failure of two mid-stage trials for its schizophrenia treatment, impacting its recent $8.7 billion acquisition of Cerevel Therapeutics.

- MicroStrategy Inc. executed its largest Bitcoin purchase to date, acquiring about 27,200 Bitcoin for approximately $2.03 billion, expanding its role as a key crypto hedge proxy.

These developments underline the varied corporate responses to recent economic shifts, with moves across industries reflecting both growth optimism and strategic shifts amid market uncertainties.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More