Global volatility is rising. Canada faces headwinds while the U.S....

Read MoreMarkets Wrap: Dow Drops Over 350 Points as S&P 500 Rally Stalls Amid Rising Treasury Yields

Market Overview:

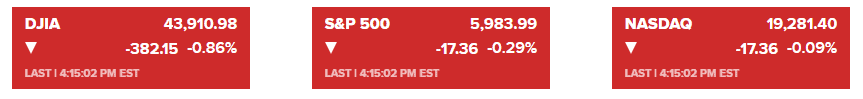

Stocks declined on Tuesday as the post-election rally slowed. The Dow Jones Industrial Average fell by 382 points (0.86%), closing below 44,000 after its recent milestone, while the S&P 500 and Nasdaq saw more modest drops of 0.29% and 0.09%, respectively, breaking a five-day winning streak. Small-cap stocks, represented by the Russell 2000, slipped 1.8%, reflecting waning momentum for key sectors that had surged on optimism surrounding tax and regulatory relief under a second Trump administration.

A combination of profit-taking and investor caution led to declines in Tesla (-6.1%) and Trump Media & Technology Group (-9%), with analysts attributing the pullback to economic concerns like high deficits and anticipated inflation data. Treasury yields rose, with the 10-year yield climbing 12 basis points to 4.43%, and the dollar reached a two-year high. Market participants are now eyeing upcoming CPI and PPI data, expected to clarify inflation trends and guide expectations for Federal Reserve policy.

According to Citigroup strategists, the recent upward momentum could stall, with possible consolidation or corrections heading into Q1 of the new year. Survey data from 22V Research suggests a mixed market reaction to inflation readings, with a majority of investors predicting minimal impact. However, some warn that financial conditions may need tightening if inflation fails to ease. Richmond Fed President Thomas Barkin indicated that the economy’s strength has allowed for rate cuts, with markets pricing in about a 55% chance of another quarter-point rate cut in December.

Corporate News:

- Qualcomm Inc.: CEO Cristiano Amon stated that despite rising AI-enabled smartphone demand, the AI boom is unlikely to trigger a global chip shortage similar to the pandemic’s disruptions.

- Apple Inc.: The European Union notified Apple that its geo-blocking practices may breach consumer protection rules, adding regulatory pressure for the tech giant in the EU.

- Meta Platforms Inc.: Meta resisted the FTC’s attempt to modify a 2020 privacy settlement, arguing any changes require federal court approval.

- Dish Network Corp.: Dish’s creditors rejected its bond-exchange offer, a key step for its proposed acquisition of DirecTV, as the deal’s deadline approaches.

- UnitedHealth Group Inc.: The U.S. Department of Justice filed a lawsuit to block UnitedHealth’s $3.3 billion acquisition of Amedisys, citing concerns about reduced competition in home health and hospice care.

- Home Depot Inc.: Adjusted its forecast for core sales growth upward, driven by increased demand for home-improvement materials due to adverse weather.

- Elliott Investment Management: The firm has accumulated over $5 billion in Honeywell International and is pressing for a breakup of the industrial giant.

- Tyson Foods Inc.: Beat fourth-quarter earnings expectations, projecting stronger results next year as its chicken division rebounds, offsetting beef segment losses.

- Hertz Global Holdings Inc.: Shares tumbled following a larger-than-expected loss from its EV investments and high depreciation costs, which have impacted earnings over the past year.

- Boeing Co.: Delivered 14 aircraft in October, its lowest since 2020, due to a union strike that disrupted production.

- American Airlines & JetBlue Airways: The two carriers are exploring renewed cooperation in the Northeastern U.S. after a previous agreement was annulled by U.S. courts.

- Shopify Inc.: Projected strong sales growth into the holiday season, signaling that its strategy of attracting larger businesses is yielding positive results.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Mortgage Refinance in 2025? Why Holding On Might Be the Smarter Move

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreCDs vs. High-Yield Savings Accounts: The Smartest Way to Grow Your Savings in 2025

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreWhy Canada’s RRSP Reform Could Save Your Retirement

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read More