How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow, S&P 500 Flat as Postelection Rally Stalls; Stocks Edge Up in Final Hour

Market Overview:

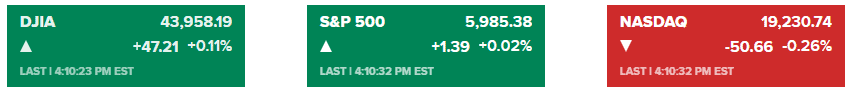

The S&P 500 and the Dow Jones Industrial Average closed near flat on Wednesday as the post-election rally appeared to lose momentum. The S&P 500 rose marginally by 0.02%, while the Dow added 47 points, or 0.11%. The Nasdaq Composite, however, dipped slightly by 0.26%. Earlier, the Dow surged over 230 points before retracting as investors weighed inflation data and the Federal Reserve’s potential December rate cuts.

The October Consumer Price Index (CPI) aligned with forecasts, showing a 2.6% annual increase, while core prices rose by 3.3%. This in-line data strengthened expectations for a possible December rate cut, with CME FedWatch indicating an 80% probability. Market sentiment remains optimistic, as December rate cuts are likely amid steady inflation data, despite potential long-term inflation concerns.

Treasury yields remained stable, with the 10-year yield at 4.45%, while the Bloomberg Dollar Spot Index rose 0.3%. Bitcoin also saw gains, briefly reaching $93,000 as investors continue to bet on supportive fiscal policies under the current administration. Upcoming economic data, including the producer price index and retail sales, will be watched closely for further signs of inflation trends and consumer behavior.

Corporate News:

- Advanced Micro Devices Inc. plans to lay off around 1,000 employees to shift focus to emerging markets, particularly artificial intelligence chips.

- Cava Group Inc. raised its full-year forecast for a third consecutive quarter, reporting strong quarterly sales that outperformed market expectations, highlighting its success in the fast-casual dining sector.

- Spirit Airlines Inc. is close to an agreement with creditors to restructure its debt in bankruptcy court after failed merger talks with Frontier Group Holdings Inc.

- Mastercard Inc. issued a forecast for slower annual net revenue growth from 2025 to 2027, announced prior to its investor day.

- Spotify Technology SA reported growth in third-quarter subscribers and profit margins, attributing gains to reduced marketing and personnel costs amid an advertising slowdown.

- Instacart posted robust third-quarter revenue, showing resilience in grocery delivery, but projected earnings below analysts’ expectations for the current period.

- Charter Communications Inc. has reached a deal to acquire Liberty Broadband Corp. through an all-stock transaction.

- Volkswagen AG increased its investment in Rivian Automotive Inc. by $800 million, signaling support for the U.S. EV company despite softer electric vehicle demand.

- Wonder Group Inc. is acquiring Grubhub from Just Eat Takeaway.com NV for about $650 million, a significant discount from its earlier $7.3 billion valuation during the early COVID-19 period.

These market moves reflect broader trends as companies reposition in evolving markets, brace for economic shifts, and prepare for potential changes in fiscal policy and consumer demand.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More