How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Drops 300 Points as Rate Concerns Stall Postelection Gains

Market Overview:

Stocks declined sharply on Friday as postelection optimism faded and concerns about Federal Reserve policy and inflation dampened sentiment. The major indexes posted their worst weekly performance in over two months:

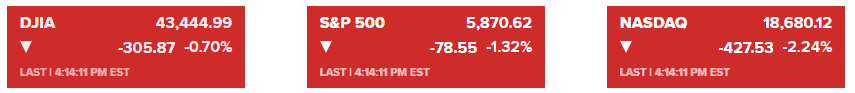

- Dow Jones Industrial Average: Fell 305.87 points (-0.70%) to 43,444.99.

- S&P 500: Dropped 1.32% to 5,870.62.

- Nasdaq Composite: Declined 2.24% to 18,680.12.

The S&P 500 and Nasdaq posted weekly losses of 2.1% and 3.2%, respectively, while the Dow slid 1.2%. Treasury yields also saw volatility, with the 10-year yield briefly reaching 4.5% before settling at 4.44%.

Retail sales data showed a 0.4% increase in October, slightly above expectations, but this failed to counterbalance concerns stemming from Federal Reserve Chair Jerome Powell’s comments. Powell emphasized a cautious approach to rate cuts, signaling the Fed is in no rush to lower rates, echoing similar remarks from other Federal Reserve officials.

Corporate News:

Technology Sector:

The information technology sector led losses, with major tech firms seeing sharp declines:- Nvidia, Meta Platforms, and Alphabet fell over 3%.

- Tesla was the only exception among the “Magnificent Seven,” rising 3%.

- Applied Materials, a key semiconductor equipment maker, experienced its largest monthly decline after issuing a weak revenue forecast.

Pharmaceutical Sector:

Pharmaceutical stocks weighed on broader indexes:- Amgen dropped 4.2%, and Moderna slid 7.3%.

- The SPDR S&P Biotech ETF (XBI) fell over 5%, marking its worst weekly performance since 2020. This followed news that President-elect Donald Trump plans to appoint vaccine skeptic Robert F. Kennedy Jr. to a major health policy role.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More