At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreMarkets Wrap: Nasdaq Rises 1% as Markets Overcome Geopolitical Tensions Ahead of Nvidia Results

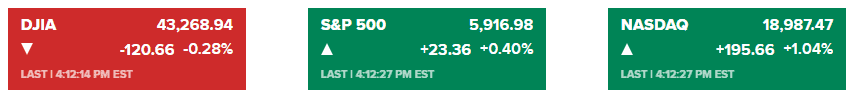

Market Overview:

The Nasdaq Composite climbed 1.04% on Tuesday to close at 18,987.47, driven by strong gains in technology stocks, particularly Nvidia, which surged nearly 5% ahead of its upcoming earnings report. The S&P 500 rose 0.4% to finish at 5,916.98, while the Dow Jones Industrial Average slipped 0.28%, closing at 43,268.94.

Geopolitical tensions between Ukraine and Russia weighed on markets early in the session. Russian President Vladimir Putin warned of a lowered nuclear threshold, following reports of U.S.-made missiles striking a Russian border region. Despite these concerns, investors largely shrugged off the headlines, focusing instead on corporate earnings and market momentum.

Treasury yields fell as investors moved toward safe-haven assets, with the 10-year yield sliding to 4.39%. Gold and oil prices also rose. The Cboe Volatility Index (VIX) spiked to 16, reflecting heightened uncertainty.

Corporate News:

- Nvidia Corp.: Shares climbed 4.9%, leading the S&P 500. Analysts view Nvidia’s earnings report as a major market catalyst, driven by continued capital expenditure from big tech and a lack of viable substitutes for its AI-driven chips.

- Walmart Inc.: Reported stronger-than-expected earnings, prompting a 3% rise in its stock. The company raised its full-year outlook, citing robust holiday sales and strong consumer demand for value.

- Tesla Inc.: Gained 2%, extending its month-to-date rally to 38%. Shares are on track for their best monthly performance since January 2023.

- Lowe’s Cos.: Reported another quarter of declining sales, reflecting continued pressure from a weak housing market.

- Alphabet Inc.: The U.S. Justice Department proposed selling its Chrome browser, a move that could value the business at up to $20 billion if approved.

- Super Micro Computer Inc.: Hired a new auditor and submitted plans to comply with Nasdaq listing requirements.

- Hewlett Packard Enterprise Co. and Juniper Networks Inc.: Representatives met with U.S. antitrust regulators to defend their proposed $14 billion merger.

Additional Insights

Bitcoin continued its post-election rally, while a “Magnificent Seven” megacap gauge rose 1.7%, further contributing to the Nasdaq’s strength. Market sentiment remains driven by corporate earnings, with Nvidia’s results positioned as a key driver for year-end performance.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

CDs vs. High-Yield Savings Accounts: The Smartest Way to Grow Your Savings in 2025

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreWhy Canada’s RRSP Reform Could Save Your Retirement

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read MoreSmart Shifts: How Canadians Are Rethinking Retirement Goals in 2025

At Berkshire’s 2025 meeting, Warren Buffett emphasized long-term investing, patience,...

Read More