How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Wall Street Steady as Nvidia Earnings Loom

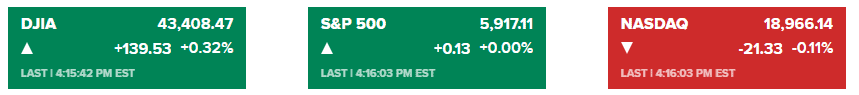

Market Overview:

The S&P 500 closed nearly flat at 5,917.11, while the Dow Jones Industrial Average gained 139.53 points (0.3%) to 43,408.47. The Nasdaq Composite slipped 0.1% to 18,966.14. The Nasdaq 100 declined 0.3%, reversing an earlier loss of more than 1% amid ongoing tensions between Ukraine and Russia.

Investor focus was on Nvidia’s highly anticipated earnings report, with its shares dipping 1% ahead of the release. The results are viewed as a major catalyst for the market, given Nvidia’s $3.6 trillion valuation and the implications for AI-driven growth.

Geopolitical tensions and the Federal Reserve’s cautious stance on rate cuts continued to weigh on sentiment. Treasuries weakened across the curve following a lackluster 20-year bond auction. Wall Street’s fear gauge, the VIX, surged for a second day, jumping as much as 15%. Meanwhile, the dollar strengthened, rebounding 0.4% after a three-day decline.

Corporate News:

- Nvidia

Nvidia’s quarterly earnings report looms large as investors await updates on demand for its Blackwell AI chips. Analysts view these results as a key driver for market momentum heading into the year-end. - Target

Target shares plummeted 21% following its largest earnings miss in two years. The company also slashed its full-year guidance, citing soft discretionary spending and cost pressures. The SPDR S&P Retail ETF fell 1.1%, with Dollar Tree, Dollar General, and Five Below dropping over 2.5% each. - Comcast

Comcast gained 1.6% after announcing plans to spin off its cable networks, including MSNBC and CNBC. The restructuring process is expected to take about a year. - Treasury Secretary Race

President-elect Donald Trump is reportedly considering Kevin Warsh and Marc Rowan for Treasury Secretary. The appointment is expected to influence key policies such as tax reforms and trade regulations.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More