How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Soars 400 Points, Russell 2000 Hits Record on Trump’s Treasury Pick

Market Overview:

U.S. stocks surged on Monday, with major indices reaching new milestones amid optimism surrounding President-elect Donald Trump’s nomination of Scott Bessent as Treasury Secretary. Investors anticipate that Bessent, a seasoned hedge fund manager and founder of Key Square Group, will balance economic growth with inflation control.

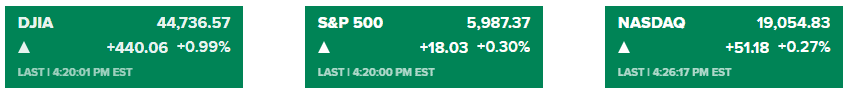

- Dow Jones Industrial Average: Rose 440.06 points (+0.99%) to 44,736.57, a new record close.

- S&P 500: Gained 0.3%, closing at 5,987.37, also a record high.

- Nasdaq Composite: Increased 0.27%, finishing at 19,054.84.

- Russell 2000: Jumped 1.47%, surpassing its previous all-time high from 2021.

The market rally extended the postelection gains, driven by expectations that Bessent’s approach will support pro-business policies while tempering protectionist measures, such as high import tariffs.

Treasury yields fell, with the 10-year yield dropping over 14 basis points, reflecting a pullback in the U.S. dollar index and a positive investor response. Meanwhile, big technology stocks showed mixed performance; Amazon and Alphabet advanced, but Nvidia and Netflix retreated.

Looking ahead, trading volumes are expected to be light due to the Thanksgiving holiday. Key data releases include October’s personal consumption expenditure price index and the Federal Reserve’s policy meeting minutes, both due Wednesday.

Corporate News:

- Macy’s Inc.: Shares declined after announcing a delay in its third-quarter earnings release due to an internal investigation uncovering over $100 million in unreported expenses by an employee.

- Bath & Body Works Inc.: The stock surged following a bullish earnings forecast.

- MicroStrategy Inc.: Purchased $5.4 billion worth of Bitcoin, setting a new record.

- Oil Market: Prices fell amid reports of progress toward a cease-fire between Israel and Hezbollah.

This broad rally underscores investor confidence in a pro-business economic agenda while showcasing sector-specific developments shaping corporate performance.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More