How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Stocks Slip as Tech Declines, Halting Record Rally

Market Overview:

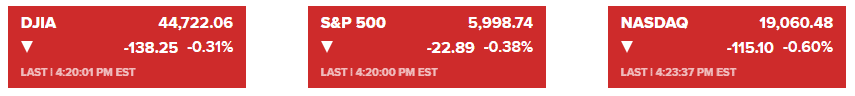

U.S. stocks fell on Wednesday in light trading ahead of the Thanksgiving holiday as investors locked in profits following substantial November gains. The S&P 500 dropped 0.38% to 5,998.74, snapping a seven-day rally. The Nasdaq Composite shed 0.6% to 19,060.48, and the Dow Jones Industrial Average slipped 0.31%, closing at 44,722.06.

Technology stocks underperformed as traders took profits on major names that have significantly outpaced the market this year. The Federal Reserve’s favored inflation gauge, the personal consumption expenditures (PCE) index, showed a 2.3% annual increase in October, aligning with expectations and reinforcing the Fed’s cautious stance on rate cuts. Treasury yields and the dollar softened, while Bitcoin rallied.

November’s market strength has been driven by postelection optimism, with the Dow up 7% for the month and the S&P 500 and Nasdaq each gaining over 5%. Analysts expect year-end momentum to continue, supported by seasonal trends and solid inflows into U.S. equities.

Corporate News:

- Nvidia, Dell, and HP: Nvidia fell over 1%, while Dell and HP tumbled more than 12% and 11%, respectively, after issuing weak earnings guidance.

- Microsoft Corp.: The Federal Trade Commission opened an antitrust investigation into Microsoft, focusing on its cloud computing, software licensing, and AI businesses.

- Autodesk Inc.: CEO Andrew Anagnost announced plans to reduce costs in sales and marketing amid pressure from activist investor Starboard Value LP.

- Uber Technologies Inc.: The FTC is investigating potential consumer protection law violations related to its subscription service.

- Urban Outfitters Inc.: Sales grew in Q3, led by its Anthropologie brand, exceeding market expectations.

- Nordstrom Inc.: The company raised the lower end of its annual sales guidance, fueled by strong quarterly results from its flagship and off-price chains.

- BlackRock, Vanguard, and State Street: A group of states led by Texas filed an antitrust lawsuit accusing the firms of driving up electricity prices through their ESG investments.

- Symbotic Inc.: Revised its Q1 revenue forecast downward and cited accounting errors delaying its annual filing.

- Brookfield Asset Management: Ended negotiations to acquire Spanish blood-plasma company Grifols SA after months of discussions.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More