How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: S&P 500 and Nasdaq Hit Record Highs to Start December

Market Overview:

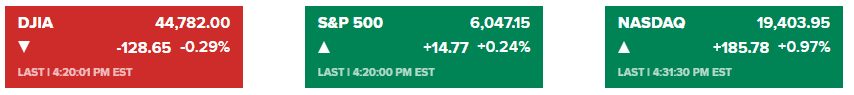

The S&P 500 and Nasdaq Composite began December trading with new record highs, extending November’s significant gains. The S&P 500 rose 0.24%, closing at 6,047.15, while the Nasdaq Composite gained 0.97% to finish at 19,403.95. Both indexes set fresh intraday and closing records. However, the Dow Jones Industrial Average fell by 0.29%, or 128.65 points, ending at 44,782.00. The blue-chip index briefly surpassed the 45,000 level during the session but could not maintain it.

November proved to be the best month of 2024 for both the Dow and the S&P 500, with gains of 7.5% and 5.7%, respectively. Small-cap stocks, represented by the Russell 2000, surged over 10% in November, marking their largest monthly gain this year.

This week, markets await critical economic data, including Friday’s payrolls report and Federal Reserve Chair Jerome Powell’s midweek remarks. Speculation about a potential December rate cut is growing after comments from Fed Governor Christopher Waller, which contributed to the ongoing rally. Treasury yields edged higher, with the 10-year rate increasing to 4.19%.

Historical patterns suggest December is typically a favorable month for equities, bolstered by seasonal and technical tailwinds. Analysts, however, warn of potential volatility as markets head into 2025.

Corporate News:

- Intel Corp. CEO Pat Gelsinger stepped down following the board’s loss of confidence in his turnaround strategy, adding further instability to the iconic chipmaker.

- Super Micro Computer Inc. saw its shares soar nearly 29% after an independent review found no evidence of misconduct and confirmed the accuracy of its financial statements. The review recommended changes to its top financial and legal leadership.

- MicroStrategy Inc. disclosed the sale of 3.7 million shares last week, using the proceeds to acquire an additional $1.5 billion worth of Bitcoin, marking its fourth consecutive weekly purchase.

- Volkswagen AG faced a temporary walkout of roughly 66,000 workers across Germany due to stalled negotiations over cost-cutting measures for its namesake brand.

- Stellantis NV CEO Carlos Tavares unexpectedly resigned, leaving the automaker without clear leadership during a pivotal moment of industry transformation.

- Tesla Inc. shares rose 3.5% following an analyst upgrade citing the company’s potential benefits from CEO Elon Musk’s rapport with President-elect Donald Trump.

- com Inc. gained over 1%, boosted by robust activity during the holiday shopping season kickoff on Cyber Monday.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More