How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: S&P 500 Hits Record High Amid Signs of Fatigue

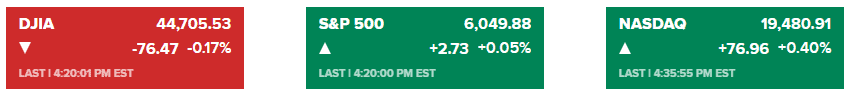

Market Overview:

The S&P 500 edged up 0.05% on Tuesday to close at a record 6,049.88. The Nasdaq Composite advanced 0.40% to 19,480.91, marking a new intraday and closing high. Meanwhile, the Dow Jones Industrial Average fell 0.17% to 44,705.53.

Investor sentiment remained cautious ahead of key jobs data expected later this week, which could provide clues on the Federal Reserve’s next move in its upcoming December meeting. The latest data indicated job openings rose to 7.74 million in October, exceeding expectations.

While the market has been buoyed by the Fed’s easing policies, some analysts warned of overcrowded bullish sentiment, noting that extreme optimism could increase volatility. Small-cap stocks continued their strong performance, with the Russell 2000 gaining more than 10% in November.

Technological advancements, particularly in AI, remain a significant driver of market gains, with technology, utilities, and financials being favored sectors.

Corporate News:

- Intel Corp.: The company is focusing on external candidates for its CEO search, reportedly considering Marvell Technology CEO Matt Murphy and former Cadence Design Systems CEO Lip-Bu Tan.

- AT&T Inc.: Predicted consistent profit growth through 2027, driven by investments in mobile and fiber-optic networks.

- BlackRock Inc.: Agreed to acquire HPS Investment Partners in a $12 billion all-stock deal, elevating its position in private credit.

- SpaceX: Is reportedly in talks to sell insider shares at a valuation of approximately $350 billion.

- Bank of Nova Scotia: Missed earnings expectations due to higher-than-anticipated expenses and taxes.

- Honeywell International Inc. and Bombardier Inc.: Settled a long-standing legal dispute and agreed to collaborate on aviation technology development.

- MARA Holdings Inc.: Acquired a wind farm in North Texas from a joint venture involving National Grid Plc and the Washington State Investment Board.

- Zscaler Inc.: Issued a weaker-than-expected forecast for adjusted Q2 earnings.

- Children’s Place Inc.: Reported earnings below analysts’ estimates.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More