How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Drops 150 Points as Wall Street Awaits CPI Report

Market Overview:

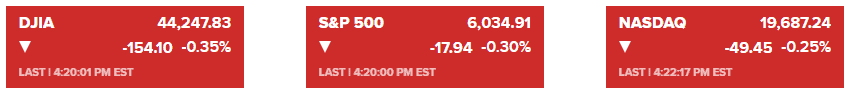

U.S. stocks, bonds, and the dollar experienced modest movements as traders await key inflation data for insights into the Federal Reserve’s next rate decision. The S&P 500 saw fluctuations, ultimately closing with a slight 0.1% loss. The Nasdaq 100 and Dow Jones Industrial Average also slipped, down 0.3% and 0.35% respectively.

The market’s focus remains on the upcoming Consumer Price Index (CPI) release, which could significantly impact rate cut expectations. Analysts predict another 0.3% monthly increase in core CPI, with year-over-year core inflation expected to hold at 3.3%. This data will be pivotal for the Federal Reserve’s final policy meeting of the year, where swap trading suggests an 80% probability of a 25-basis-point rate cut.

Treasury yields climbed slightly, with the 10-year yield rising by two basis points to 4.22%. The Bloomberg Dollar Spot Index added 0.1%, reflecting cautious sentiment ahead of the CPI report.

Corporate News:

- Alphabet Inc.: Shares surged 5.6% following the announcement of a quantum computing breakthrough using its Willow quantum chip.

- Oracle Corp.: The stock tumbled 6.7% after fiscal Q2 results fell short of expectations, despite a strong performance earlier this year.

- Taiwan Semiconductor Manufacturing Co.: November sales increased 34%, driven by robust AI-related demand.

- Boeing Co.: Resumed assembly of its bestselling aircraft after a 53-day strike, with deliveries in November at their lowest in four years.

- Walgreens Boots Alliance Inc.: Reportedly in acquisition talks with Sycamore Partners amidst ongoing financial struggles.

- C3.ai Inc.: Reported better-than-expected quarterly revenue and raised its full-year sales forecast.

- Eli Lilly & Co.: Announced a $15 billion stock buyback program and a 15% increase in its quarterly dividend, supported by strong growth in its weight-loss drug Zepbound.

- Alaska Air Group Inc.: Revealed global expansion plans and upgraded its profit forecast.

- MongoDB Inc.: Posted strong Q3 results but announced the departure of CFO Michael Gordon, raising analyst concerns despite Guggenheim’s positive outlook.

Key Developments to Watch:

- Wednesday’s CPI release will be critical, with investors divided on the potential market reaction. A softer inflation reading could fuel a year-end rally, while a higher-than-expected figure may increase volatility.

- Fed officials are expected to monitor CPI closely for any signs of stalled inflation progress, which could influence the likelihood of a rate cut.

The overall market sentiment reflects caution, with some analysts viewing current bullishness as a contrarian indicator, suggesting potential overbought conditions heading into 2025.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More