How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Nasdaq Tops 20,000 as CPI Boosts Big Tech to Record Highs

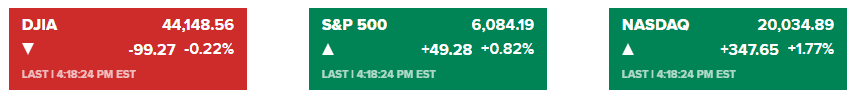

Market Overview:

Investors’ enthusiasm for US technology giants sent stocks higher Wednesday, snapping a two-day slide after a benign inflation report cemented expectations that the Federal Reserve will continue to cut interest rates. The Nasdaq 100 climbed 1.9% to a record while the S&P 500 rose 0.9%, nearing a recent peak. Broadcom Inc. led the advance following a report that the chipmaker was working on an AI deal with Apple Inc. The so-called Magnificent Seven stocks were once again in the pole position, with Apple, Amazon.com Inc., and Facebook parent Meta Platforms Inc., setting all-time highs. Wall Street’s optimism remains intact even as inflation remains stubbornly above the central bank’s target.

Corporate News:

- Apple Inc. is developing a server chip designed especially for artificial intelligence and is working with Broadcom on the chip’s networking technology, the Information reported, citing a person with direct knowledge of the project.

- UnitedHealth Group Inc. and CVS Health Corp. were among health-care companies under pressure after Bloomberg reported a bipartisan coalition of US lawmakers has drafted legislation that would force prescription drug middlemen to divest pharmacies they own.

- Hershey Co.’s main owner rejected a preliminary takeover offer from Mondelez International Inc., potentially ending a fresh pursuit that would’ve created a food giant with combined sales of almost $50 billion.

- GameStop Corp. shares rose after the videogame retailer reported a surprise third-quarter profit as the company’s cost-cutting measures pay dividends.

- Walgreens Boots Alliance Inc. shares fell as analysts questioned the probability of Sycamore Partners acquiring the pharmacy chain. On Tuesday, the stock jumped 18% after a report the two sides were in talks over a potential sale.

- PJT Partners Inc.’s chief executive officer stated that next year could be the second-biggest for mergers and acquisitions in a decade, and his firm has been on an “aggressive” hiring spree to prepare.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More