How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Falls as Inflation Data Weighs on Market, Tech Stocks Decline

Market Overview:

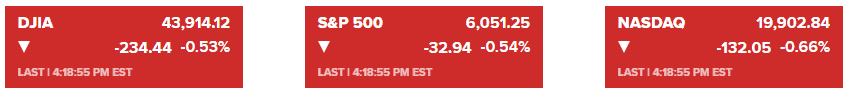

Stocks fell Thursday, weighed down by hotter-than-expected U.S. inflation data and a pullback in technology shares. The Nasdaq Composite declined 0.66%, closing at 19,902.84, slipping below the 20,000 threshold. The S&P 500 dropped 0.54% to 6,051.25, while the Dow Jones Industrial Average fell 0.53% to 43,914.12, marking its sixth consecutive losing session.

The producer price index (PPI) for November rose 0.4%, surpassing economists’ expectations of 0.2%, and initial jobless claims for the week ending Dec. 7 increased to 242,000, above the forecasted 220,000. Following this data, the 10-year Treasury yield climbed to a two-week high of 4.33%.

Investor sentiment remains focused on the Federal Reserve’s upcoming policy meeting, where a third consecutive interest rate cut of 0.25% is widely anticipated. However, market participants are wary of the Fed’s projections for 2025, particularly given persistent inflationary pressures and mixed economic signals.

In global markets, the European Central Bank and Swiss National Bank announced rate cuts, with the ECB reducing rates by a quarter point and Switzerland surprising markets with a 50 basis-point cut. Canada also reduced its policy rate by half a point earlier this week.

Corporate News:

- Riot Platforms Inc.: Shares surged following news that activist investor Starboard Value had acquired a significant stake in the Bitcoin mining company.

- Adobe Inc.: The stock dropped more than 13% after releasing a disappointing 2025 sales forecast, raising concerns about potential competition from AI-driven startups.

- Warner Bros Discovery Inc.: The company announced plans to restructure its corporate organization, creating distinct divisions for cable and streaming operations.

- ServiceTitan Inc.: Shares opened 42% above the IPO price after the residential and commercial repair software company raised $624.8 million in its initial public offering.

- Apple Inc.: Apple plans to begin using in-house chips for Bluetooth and Wi-Fi in its devices starting next year, replacing components currently supplied by Broadcom Inc.

Commodities

WTI crude oil pared losses after the International Energy Agency warned of a potential supply glut in 2025. Gold fell 1.6%, marking its largest intraday decline in over two weeks.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More