How much do Canadians need to retire? Surveys show the...

Read MoreMarkets Wrap: Dow Falls for Eighth Day Ahead of Fed, While Nasdaq Hits Another Record

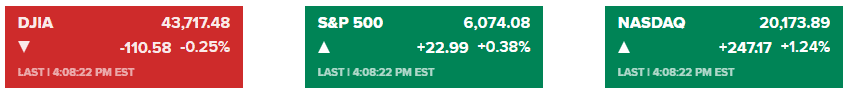

Market Overview:

U.S. stocks moved higher on Monday, driven by optimism surrounding the Federal Reserve’s upcoming policy decision. The Nasdaq Composite rose 1.2% to a record high, bolstered by gains in tech stocks. The S&P 500 added 0.4%, while the Dow Jones Industrial Average fell 110 points, marking its eighth consecutive losing session—the longest streak since 2018.

Investor sentiment remains positive ahead of the Federal Reserve’s anticipated quarter-point rate cut on Wednesday. This would mark the Fed’s third rate cut since September. Traders are also closely monitoring forward guidance for clues on future policy shifts.

Economic data showed mixed signals. Activity in the U.S. service sector expanded at its fastest pace since October 2021, while New York state factory activity declined sharply. Globally, weaker-than-expected retail data in China weighed on markets in Asia and Europe, contrasting with the U.S.’s upbeat performance.

In the bond market, the 10-year Treasury yield held steady at 4.40%. The Bloomberg Dollar Index fluctuated, reflecting market uncertainty about the dollar’s trajectory amid rate cuts and economic policy developments.

Corporate News:

- Tech Leaders Drive Nasdaq Higher: Shares of Apple, Alphabet (Google’s parent company), Tesla, and Broadcom all hit new all-time highs. Broadcom led gains with an 11% increase, pushing the company’s market capitalization above $1 trillion for the first time.

- Nvidia Pulls Back: Nvidia, a market favorite over the past two years, fell over 2%, entering a correction phase with a 10% decline from its mid-November peak.

- MicroStrategy Soars: MicroStrategy climbed sharply after news of its upcoming inclusion in the Nasdaq 100. The software company’s transformation into a major Bitcoin investor continues to drive its stock performance.

- Tesla Gains on EV Optimism: Tesla’s rally added to the Nasdaq’s strength, as the electric vehicle maker reached another record high amid optimism surrounding its growth prospects.

Focus on the Fed

Markets are bracing for Wednesday’s Federal Reserve decision, with the expected rate cut providing support for equities. Investors are keen to hear Federal Reserve Chair Jerome Powell’s comments on inflation and economic growth during the post-meeting press conference.

The decision will set the tone for global central bank meetings later this week, including policy announcements from Japan, the UK, and the Nordic region. These meetings will shape market movements as 2024 approaches its close.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More