How much do Canadians need to retire? Surveys show the...

Read MoreDow Suffers 10-Day Losing Streak as S&P 500 Posts Worst Day Since August

Market Overview:

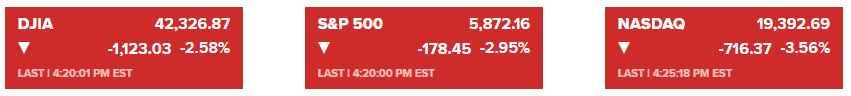

The Dow Jones Industrial Average extended its historic losing streak, marking a 10th consecutive day of declines, its longest since 1974. The index fell 1,123.03 points, or 2.58%, to close at 42,326.87. The S&P 500 dropped 2.95% to 5,872.16, while the Nasdaq Composite lost 3.56%, ending at 19,392.69. Both indices experienced their worst day since August, with market losses intensifying toward the close of trading.

Bond yields surged following the Federal Reserve’s rate decision. The policy-sensitive two-year Treasury yield rose 10 basis points to 4.35%, while the 10-year yield climbed above 4.50%. Meanwhile, the Bloomberg Dollar Index reached its highest level since November 2022.

Federal Reserve Policy Update

The Federal Reserve reduced its overnight borrowing rate by 0.25 percentage points to a target range of 4.25%-4.50%. However, the central bank signaled a more cautious outlook for rate cuts in 2025, reducing the expected number from four to two. Fed Chair Jerome Powell emphasized the need for a cautious approach, stating that the current rate remains “meaningfully restrictive.” Powell also reaffirmed the Fed’s commitment to achieving its 2% inflation target, suggesting a prolonged restrictive monetary policy environment.

Market participants reacted negatively to the Fed’s updated forecast, with traders adjusting expectations for the pace of future rate cuts. Treasury yields jumped in response, adding pressure to equity markets.

Corporate News:

- Horizon Investments: Scott Ladner noted that the Fed’s hawkish stance reflects inflation concerns rather than economic robustness, signaling a prolonged path to neutral rates.

- Franklin Templeton Investment Solutions: Senior Vice President Max Gokhman characterized Powell’s approach as “a hawk in dove’s clothing,” highlighting the necessity of restrictive policy amid strong economic momentum.

- Goldman Sachs Asset Management: Whitney Watson projected a pause in rate cuts in January, with easing resuming in March, reflecting the Fed’s measured approach to rate adjustments.

Conclusion

The stock market faced broad declines, led by rate-sensitive sectors, as the Federal Reserve’s cautious tone on future rate cuts reshaped market expectations. Bond yields and the dollar strengthened, underlining investor apprehension about the path of monetary policy.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More