How much do Canadians need to retire? Surveys show the...

Read MoreWall Street Slips in Volatile Start to 2025

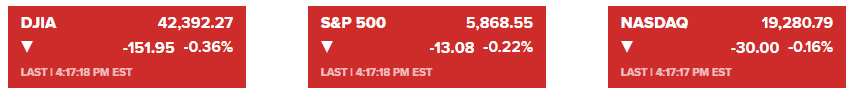

Market Overview:

On Thursday, major U.S. stock indices extended their losing streak into the new year. The Dow Jones Industrial Average fell 151.95 points (0.36%) to close at 42,392.27. The S&P 500 dropped 0.22% to 5,868.55, while the Nasdaq Composite slipped 0.16% to 19,280.79. Both the S&P 500 and Nasdaq recorded their fifth consecutive day of losses, the longest streak since April.

Early gains during the session reversed in late morning trading, with the Dow’s intraday swing exceeding 700 points. Treasury yields were volatile as well, with the 10-year benchmark yield reaching nearly 4.6% before retreating. Bond market movements reflect ongoing investor concerns over elevated stock valuations.

Despite a strong 2024 that saw the S&P 500 rise 23%, the year ended on a sour note with four consecutive days of declines, marking the first time since 1966. This extended into the first trading day of 2025, diminishing hopes for a “Santa Claus rally,” which historically indicates a positive market trend in the final and initial trading days surrounding the new year.

Corporate News:

- Tesla: Shares declined by 6% after the company reported a drop in annual vehicle deliveries for 2024, marking the first decline in over a decade. The stock’s five-day slump, totaling nearly 20%, is its worst performance in over two years.

- Apple: The tech giant fell 2.6%, contributing to broader declines in Big Tech.

- Nvidia: Shares rose 3%, partially offsetting losses in other technology stocks.

- Energy Sector: European energy stocks outperformed as natural gas prices surged due to freezing winter temperatures and the expiration of a key transit contract between Ukraine and Russia.

Economic Data

Jobless claims data showed both initial and continuing unemployment claims declined to an eight-month low, indicating resilience in the labor market. However, seasonal adjustments during the holiday period may affect the accuracy of these readings.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More