How much do Canadians need to retire? Surveys show the...

Read MoreStocks Snap Five-Day Losing Streak but End Week Lower

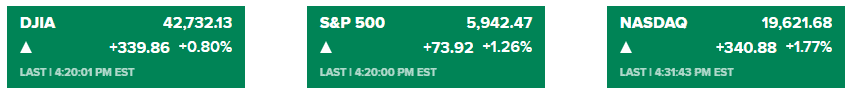

Market Overview:

U.S. stocks closed higher on Friday as Wall Street recovered from a rocky start to the new year. The S&P 500 gained 1.26% to close at 5,942.47, while the Dow Jones Industrial Average rose 0.8% to 42,732.13. The Nasdaq Composite advanced 1.77% to 19,621.68.

Investors were encouraged by broad-based gains, snapping a five-day losing streak for the S&P 500 and Nasdaq. However, all major indices ended the week in the red, with the S&P 500 losing 0.48%, the Dow 0.60%, and the Nasdaq 0.51%.

Economic data showed modest growth in U.S. manufacturing in December, as the ISM index rose to 49.3, slightly below the expansion threshold but above expectations. New orders reached their highest levels since early 2023. Bond yields climbed, with the 10-year Treasury yield hitting 4.6% following hawkish comments from Richmond Fed President Tom Barkin.

Global Markets and Commodities

Chinese stocks faced their worst start to a year since 2016, as concerns about the nation’s economic growth deepened. The yuan weakened past the 7.3-per-dollar mark, and the 10-year Chinese government bond yield hit a record low of 1.6%.

In commodities, WTI crude extended its rally for the fifth consecutive day, reaching $74 per barrel. Gold trimmed its weekly gains amid stronger risk sentiment.

Corporate News:

- Technology and AI

Tech stocks led Friday’s rally. Nvidia rose 4.7%, while Super Micro Computer jumped 10.9%. Microsoft announced plans to invest $80 billion in AI-enabled data centers in the 2025 fiscal year, boosting shares of power producers Constellation Energy (+4%) and Vistra (+8.5%).

- S. Steel Acquisition Blocked

President Biden formally blocked the proposed $14.1 billion acquisition of U.S. Steel by Nippon Steel. This decision followed a U.S. security review and heightened political tensions between the U.S. and Japan. Shares of U.S. Steel fell 6.5%.

- Alcohol Warning Advisory

Alcohol stocks declined after the U.S. Surgeon General recommended that labels on alcoholic beverages include warnings about cancer risks. Molson Coors fell 3.4%, Constellation Brands lost 2.3%, and Anheuser-Busch InBev in Brussels dropped 2.8%.

- Market Sentiment

The reelection of Mike Johnson as House Speaker fueled optimism about potential business-friendly deregulation under the incoming administration. Investors continue to watch closely for clarity on policies ahead of the January 20 presidential inauguration.

*All data in this blog is sourced from reputable media outlets such as CNBC, Yahoo Finance, and Bloomberg. If any content infringes on copyright, please notify us for immediate removal.

Recent Posts

You may also interested in

Canada Mortgage Debt 2025 Nears $2 Trillion as Renewal Wave and Starter Home Crisis Intensify | AiF News Bites

Canada mortgage debt 2025 approaches $2 trillion as mortgage renewals...

Read MoreCanada Restaurant Tips Disruption: Millions in Funds Missing as Bank of Canada Steps In | AiF News Bites

Canada restaurant tips platform disruptions have left restaurants facing missing...

Read MoreAmazon vs Walmart Revenue: AI Is Reshaping the Retail Industry | AiF News Bites

Amazon vs Walmart revenue reached a historic shift as Amazon...

Read More